Buy DCB Bank Ltd For Target Rs. 165 by Motilal Oswal Financial Services Ltd

NII in line; healthy other income drives earnings beat

Business growth remains robust

* DCB Bank (DCBB) reported 13.8% YoY growth in PAT to INR1.8b (12% beat), driven by better other income and lower-than-expected provisions.

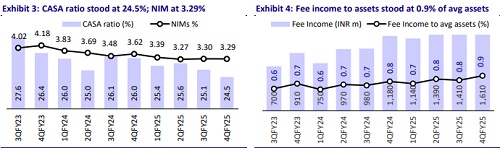

* NII grew 9.9% YoY/2.8% QoQ to INR5.6b (largely in line). NIMs inched down 1bp to 3.29%. Other income grew 60.7% YoY/18.9% QoQ (16% higher than est.).

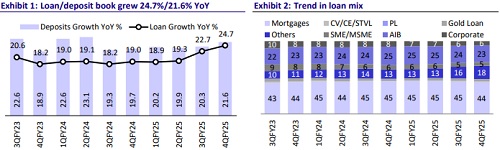

* Business growth was robust as advances grew 24.7% YoY/6.8% QoQ to INR510.5b and deposits grew at a healthy pace of 21.6% YoY/5.9% QoQ to INR600.3b, led by faster growth in TDs. CASA mix thus reduced by 57bp QoQ to 24.5%.

* Fresh slippages declined to INR3.66b (vs. INR3.95b in 3QFY25). GNPA ratio improved by 12bp QoQ to 2.99% and NNPA ratio improved by 6bp QoQ to 1.12%. PCR increased to 63.2%.

* We raise our earnings estimates by 2.7% for FY26/FY27 and expect FY27 RoA/RoE at 0.95%/15.1%. Reiterate BUY with a TP of INR165 (based on 0.8x FY27E ABV).

NIM largely flat; GNPA ratio improves 12bp QoQ

* DCBB reported 13.8% YoY/16.9% QoQ growth in PAT to INR1.8b (12% beat), led by better other income, in-line NII and lower-than-expected provisions.

* NII grew 9.9% YoY/2.8% QoQ to INR5.6b (inline). NIMs declined marginally by 1bp QoQ to 3.29%. Other income was robust at INR2.19b, up 61% YoY/ 19% QoQ, supported by strong fee income and treasury gains. Management expects the 50bp repo rate cut to have a negligible impact on margins, though more rate cuts may create pressure on NIMs.

* Opex grew 15% YoY to INR4.7b (in line). C/I ratio thus declined by 202bp QoQ to 60.7% amid contained employee growth. PPoP grew 30.7% YoY/ 12.6% QoQ (7% beat). Provisions came in lower at INR672m (flat QoQ, 6% lower than MOFSLe).

* Advances growth was robust at 24.7% YoY/ 6.8% QoQ, led by healthy growth in mortgages, gold and agri loans. Co-lending too grew at a healthy pace of 116% YoY; however, the bank expects FY26 co-lending growth to be slower YoY.

* Deposits grew 21.6% YoY/5.9% QoQ to INR600.3b, driven by term deposits. CASA mix thus moderated by 57bp QoQ to 24.52%. CD ratio stood at 85%.

* Fresh slippages declined to INR3.66b (vs. INR3.95b in 3QFY25). GNPA ratio declined by 12bp QoQ to 2.99% and NNPA ratio declined by 6bp QoQ to 1.12%. PCR increased to 63.2%. The restructured book declined marginally to INR8.2b (1.6% of loans).

Highlights from the management commentary

* The bank operates with a provision cost model of 45-55bp. FY25 ended at 31bp, even after factoring in the pressure from MFI loans. Despite making accelerated provisions, provisioning remained lower than the guided range.

* With a 50bp rate cut, NIMs are likely to hold the current levels, but further cuts could create pressure.

* NII growth has lagged loan growth, primarily due to the 4Q rate cut and higher CoF. With ongoing adjustments in yields and funding costs, NII and loan growth are expected to converge.

* Only a portion of the loan book is EBLR-linked and floating, limiting the impact of rate cuts.

Valuation and view

DCBB reported healthy earnings, driven mainly by healthy other income, in-line NII, and lower-than-expected provisions. Margins stood largely flat in 4Q, while improvement in yields was offset by increase in CoF. Management expects NIM to be manageable with a 50bp repo rate cut, while any further cut could result in a downwards bias for NIMs. Loan growth was steady, and we expect loan growth to remain healthy over the next few years, driven by expansion in the secured retail assets, while deposit growth too shall be following a healthy trend. Fresh slippages have been on a decline, resulting in continuous improvement in asset quality. The restructured book too follows a declining trend over the past few quarters. We raise our earnings estimates by 2.7% for FY26/FY27 and expect FY27 RoA/RoE at 0.95%/15.1%. Reiterate BUY with a TP of INR165 (based on 0.8x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412