Neutral Federal Bank Ltd for the Target Rs. 230 by Motilal Oswal Financial Services Ltd

.jpg)

NII and PPoP in line; lower provisions drive earnings beat

Asset quality remains steady

* Federal Bank (FB) reported 4QFY25 earnings of INR10.3b (12% beat) amid lower provisions and healthy other income.

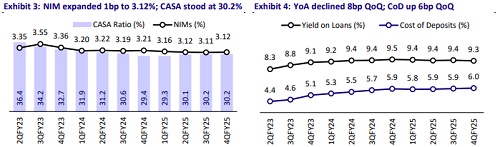

* NII was in line, while NIM stood broadly flat (up 1bp QoQ to 3.12%), as the bank focused on reorienting its asset mix with the goal of improving yields and increasing its CASA deposits.

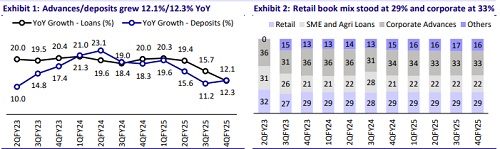

* Advances grew 12% YoY/ 2% QoQ, while deposits grew 12.3% YoY/6.5% QoQ, largely driven by CA deposits. The CASA mix improved 7bp QoQ to 30.2%.

* Total slippages stood at INR4.9b vs INR5b in 3QFY25. GNPA/NNPA ratios declined 11bp/5bp QoQ, respectively, to 1.84%/0.44%, while restructured book declined 7bp QoQ to 0.6%. Credit cost stood at 26bp for 4QFY25.

* We fine-tune our earnings projections and estimate RoA/RoE of 1.25%/14.0% by FY27. Reiterate BUY rating with a TP of INR230 (1.4x FY27E ABV).

CD ratio declines to ~82.8%; LCR ratio improves 23% QoQ to 142%

* FB reported 4QFY25 earnings of INR10.3b (12% beat) amid lower provisions and healthy other income. For FY25, PAT grew 9% YoY to INR40b.

* NII stood in line at INR23.8b (up 8.3% YoY/ down 2.2% QoQ), while NIMs expanded marginally by 1bp QoQ to 3.12%.

* Other income rose 33% YoY (10% QoQ) to INR10.1b (10% beat) amid steady core fee income. Provisions stood at INR1.4b (43% lower than MOFSLe), aided by a corporate recovery.

* Opex stood at INR19.2b (4% YoY, 4% higher than MOFSLe), while the C/I ratio increased to 56.7%. The bank expects a C/I ratio of ~53-53.5% over the next few quarters. PPoP increased 32% YoY to INR14.6b (in line).

* On the business front, advances grew 12% YoY/2% QoQ. Retail grew 2% QoQ, while SMEs grew 3.3% QoQ. CV/CE grew 10% QoQ and corporate grew 3% QoQ. The credit card business has grown well at 3% QoQ and the bank aims to continue growing this segment.

* Deposits grew 12.3% YoY/6.5% QoQ, largely driven by CA deposits, which grew 27% YoY. The CASA mix improved 7bp QoQ to 30.2%. The bank’s overall CD ratio remained comfortable at 82.8% (down 370bp QoQ), while the LCR ratio improved 2,342bp QoQ to 142%.

* Total slippages stood at INR4.9b vs INR5b in 3QFY25. GNPA/NNPA ratios declined 11bp/5bp QoQ, respectively, to 1.84%/0.44%. Reported PCR stood healthy at 75.4%. Restructured book declined 3bp to 0.7%. Credit costs stood at 26bp for 4QFY25.

Highlights from the management commentary

* The bank aims to deliver 1.2x-1.5x of banking system growth with a focus on sustainable performance.

* Deposit growth has been strong, with retail and wholesale CAs accelerating. The CA acquisition rate on the retail side is at least 50% higher than it was six months ago.

* The growth rate is fairly strong at 19% YoY in the medium-yield segment. Credit card growth has been robust, with the bank pursuing both organic and inorganic growth in this space.

* On NIM, an increase in yields on investments and other assets has helped maintain margins despite a cut in repo rates.

* Of the 85 branches opened in FY25, 39 were opened in 4Q, with some one-offs leading to an increase in cost. The bank expects the C/I ratio to be ~52.5-53.5% over the next few quarters.

Valuation and view: Reiterate BUY with a TP of INR230

FB reported a healthy quarter as lower provisions and healthy other income led to an earnings beat. Margins stood broadly flat with 1bp QoQ expansion. Deposits growth was steady as the bank focused on current account deposits (up 27% YoY), which led to a marginal improvement in the CASA ratio. Opex stood elevated as the bank continued to invest in branches, people, and technology. Asset quality remained steady with credit costs remaining in control, while PCR improved to 76%. We believe that FB is well-placed among mid-sized private sector banks to deliver a healthy earnings trajectory, supported by steady business growth and gradual improvements in margins and operating leverage. Under the new leadership and strategy, the bank aims to deliver sustained growth and superior profitability. We fine-tune our earnings projections and estimate RoA/RoE of 1.25%/14.0% by FY27E. Reiterate BUY rating with a TP of INR230 (1.4x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412