Neutral Piramal Finance Ltd for the Target Rs. 1,250 by Motilal Oswal Financial Services Ltd

Driving transformation through ‘AI-native’ strategy

We attended Piramal Finance’s (PIEL) Piramal.AI day, where the company showcased its extensive use of AI across all business functions and demonstrated how it is driving improvements in efficiency and productivity. Below are the key takeaways:

* The Piramal.AI day provided a comprehensive overview of PIEL's strategic transformation into what it terms an 'AI-native' organization, where AI is deeply embedded in every facet of the business. The event showcased how a series of foundational choices, such as developing all technology inhouse and adopting a cloud-native architecture, have enabled the company to achieve significant growth, enhance operational productivity, and improve risk management.

* Management detailed the company's journey from a wholesale-led entity to a retail-first NBFC, highlighting its 4x growth in four years after the DHFL merger, a feat that positions it as one of the fastest-growing NBFCs in Indian history. The sessions included live demonstrations of a suite of proprietary AI tools that are not theoretical pilots but are fully integrated into core business processes, from customer onboarding and underwriting to collections and customer experience.

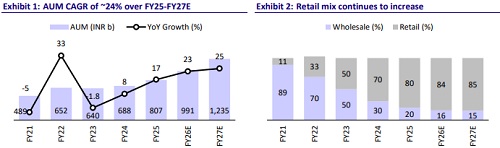

* AI-driven efficiencies have helped PEIL lower its long-term opex-to-AUM guidance by 25bp to 3.25-3.5%. The company has provided a positive outlook, guiding for significant growth in PAT and AUM through to FY30. It guided for a scale-up in AUM to ~INR1.5t+ by FY28 and INR2t+ by FY30 (AUM CAGR of ~20-25% over FY25-30). On profits, it guided for PAT of ~INR13b-15b in FY26, ~INR45b by FY28 and ~INR65b by FY30.

Strategic shift toward retail dominance

* PIEL has transitioned from wholesale to retail, scaling rapidly with diversified products, wider geography, strong cross-selling, and higher productivity. The company highlighted that its AUM has expanded from a little over INR200b in Sep’21 to nearly ~INR800b within four years, a 4x increase that very few financial institutions in India have achieved at such scale and speed.

* Crucially, this rapid growth has not come at the expense of credit quality. Even with a fourfold increase in the loan book, delinquency has remained stable. Moreover, a static pool analysis shows that more recent cohorts are performing better than earlier ones, underscoring that growth has been achieved while strengthening credit quality rather than by taking on additional risk.

* PIEL is positioning itself as an AI-native financial institution, embedding AI across every process rather than limiting it to pilots or experiments. The company views AI and technology as the next phase of its transformation, supported by significant investments in in-house talent, a scalable cloudfirst architecture, and deep integration of AI into core operations.

Pillars of sustained growth

* Product expansion: The company has steadily diversified its portfolio, evolving from offering only housing loans up to FY20 into a broad suite of 19 products today. While housing loans have grown at a CAGR of ~20%, the non-housing portfolio has expanded much faster at a 45% CAGR. This reflects a deliberate multi-product strategy aimed at underpenetrated segments within the banking sector.

* Geographic expansion: The distribution footprint now spans 517 branches across 26 states and 428 cities, including 76 microfinance branches. A substantial branch rollout over the last three years is expected to add nearly INR80b to AUM as these branches mature and scale up during the current year.

* Cross-selling and partnerships: Cross-selling has become a meaningful contributor, accounting for ~25% of unsecured disbursements and ~10% of total disbursements, with a target of reaching 50% in unsecured lending (vs. Bajaj at ~60%). Fintech partnerships continue to be leveraged primarily for customer acquisition, with disbursements of about INR150b through these channels to date.

* Productivity and cost efficiencies: Operating expense ratios have improved sharply, declining by ~230bp over the last nine quarters, driven largely by AIenabled productivity gains. Branch productivity has risen significantly, with AUM and disbursements per branch up 1.7x, revenue per branch up 1.8x, and disbursements per employee up 1.4x.

Foundation of AI: The 'Build, Not Buy' philosophy

* PIEL has deliberately built its technology and AI stack fully in-house, treating AI as core to financial services much like underwriting, rather than as an outsourced or experimental function. This base has allowed the company to scale AI adoption in production systems faster than peers, positioning itself as an AI-native financial institution.

* The company’s philosophy is clear: AI should be seamlessly integrated across customer journeys, underwriting, collections, fraud detection, and internal workflows. Rather than running pilots or proofs of concept that stay disconnected from operations, the focus is on deploying AI solutions directly into production at scale.

* The company has already moved to agentic AI in live production, leveraging advanced protocols like MCP and A2A. This positions PIEL at the forefront of AI adoption, well ahead of peers who are still operating at predictive or early generative stages.

Why PIEL succeeded in its AI pilots and deployment

* An MIT study highlights that 95% of AI pilots fail due to weak operational alignment, excessive focus on technology over outcomes, or reliance on generic tools. PIEL has sidestepped these issues by adopting a business-first approach, tightly integrating AI into core systems, and developing custom domain-specific SLMs that reflect its internal terminology and context.

* With in-house development ensuring ownership and strategic alignment, Piramal has emerged as one of the few enterprises to achieve real, large-scale success in AI adoption.

Advancing results through AI integration

* AI adoption has delivered clear, measurable gains for Piramal, with underwriting outcomes strengthening as horizontal risk fell 40% YoY for three consecutive years and fraud risk (straight flows 90+ dpd) declined by over 50% annually over the same period.

* Productivity has also seen a step change, with sales efficiency rising 25%, credit manager output up 20%, operations manager productivity nearly 60% higher, and call center productivity improving 17%, alongside faster loan disbursements and throughput that have supported stronger growth.

* Customer experience has improved meaningfully, with the quarterly complaint ratio falling from 2.6 per thousand to just 0.4 per thousand in about three years. Developers have been empowered, with nearly half of all codes now AIgenerated, enabling faster development and smoother integration.

Tangible business impact and future outlook

* With proven success in AI adoption, the company is factoring in an additional 25bp in opex savings alongside a stronger AUM growth outlook.

* Earlier guidance for the long-term opex-to-AUM ratio was 3.5-4.0%. However, with continuous productivity and efficiency gains from AI, PIEL has now lowered its opex-to-AUM guidance to ~3.25-3.5%.

* AUM growth momentum is expected to remain steady, with a target of reaching ~INR1t in FY26, INR1.5t+ in FY28, and INR2t+ in FY30. Further, PAT is expected to scale up to INR13-15b in FY25, INR45b in FY28, and INR65b in FY30.

Valuation and view

* PIEL’s strategic shift toward building a granular and diversified retail franchise, alongside a calibrated wholesale 2.0 book, continues to gain traction. The company has demonstrated steady progress on asset quality, with volatility now largely behind and credit costs expected to remain stable. With new product launches such as co-branded credit cards and gold loans in the pipeline, the company is expanding its fee income base and diversifying its earnings profile.

* Our FY26 earnings estimate factors in exceptional gains from the Piramal Imaging business, gains from AIFs and no tax incidence in the foreseeable future. Because of the uncertainty and unpredictability around the timing of the monetization of its stake in Shriram Life and General Insurance, we have not factored it into our estimates. It does, however, provide streams of one-off gains, which can help to offset credit costs required to dispose of residual (if any) stressed legacy AUM.

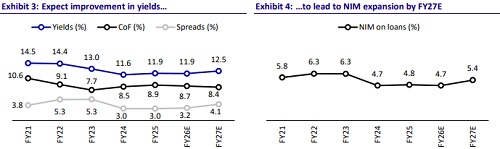

* While the company anticipates greater earnings stability and an improved outlook going forward, its return metrics remain modest, with RoA and RoE estimated at 1.9% and 8%, respectively, for FY27E. We value the lending business at 0.8x FY27E P/BV. Reiterate our Neutral rating on the stock with a revised TP of INR1,250 (premised on Mar’27E SOTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412