Neutral GSK Pharma Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Temporary hiccups lead to muted performance on a YoY basis

Outlook promising in Vaccines/New Oncology launches

* GlaxoSmithKline Pharmaceuticals (GLXO) reported lower-than-expected revenue for the quarter. However, EBITDA/PAT were slightly higher than expectations, as controlled costs resulted in improved profitability.

* After a healthy pick-up in YoY revenue growth in FY24/FY25, GLXO achieved a revenue decline on a YoY basis in 2QFY26/1HFY26. Certain one-time events like the GST transition and the fire incident at GLXO’s CMO partner impacted the company’s performance during the quarter and 1HFY26.

* GLXO continues to maintain a strong lead in the vaccine market with offerings for both pediatrics and adults. The company has reached ~400K healthcare professionals (HCPs) to market its vaccine portfolio. Specifically, for Shingrix, it reached 38k HCPs in 2QFY26.

* In addition to vaccines, GLXO is building a specialty portfolio in the respiratory and oncology segments. Products launched in the oncology segment have also been well-received by HCPs.

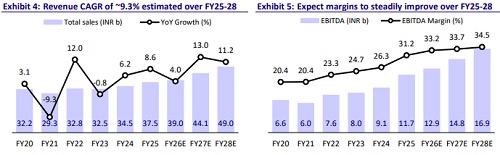

* We largely maintain our estimates for FY26/FY27/FY28. We value GLXO at 38x 12M forward earnings to arrive at a TP of INR2,800.

* After resolving temporary issues and marketing efforts towards the specialty portfolio, we expect GLXO to deliver a 13% earnings CAGR over FY25-28. The current valuation factors in the earnings upside and, hence, we maintain a Neutral rating on the stock.

Product mix and better operating leverage lead to higher margins YoY

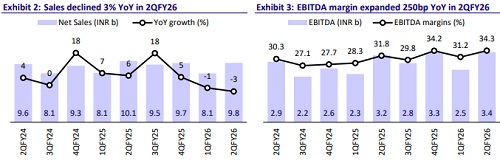

* Revenue declined 3% YoY to INR9.8b (est: INR10.3b).

* Gross margin (GM) expanded 175bp YoY to 63.7%.

* EBITDA margin expanded 250bp YoY to 34.3% (our est: 31.4%) due to steady other expenses costs and a cut in employee costs on a YoY basis (down 80bp YoY as a % of sales).

* EBITDA grew 4.4% YoY to INR3.3b (vs. est. of INR3.2b).

* Adjusted PAT grew 3% YoY to INR2.5b for the quarter (in line with our est. of INR2.4b). The exceptional item was on account of profit on the sale of surplus residential properties.

* For 1HFY26, revenue decreased 2.2% YoY and EBITDA/PAT grew 6.3%/6.9%

Key highlights from the management commentary

* The topline was impacted by the fire incident at a major CMO plant and the GST transition.

* From 2HFY26 onwards, operations are expected to stabilize as the fire incident has been fully addressed and remediated.

* Strong double-digit YoY growth was observed in both periodic vaccines and adult shingles vaccines.

* 2QFY26 marks a symbolic comeback with the company entering the oncology segment.

* GLXO launched key global assets, Gemperli/Jejula, in endometrial/ovarian cancer, creating new growth avenues.

* Employee headcount remains moderate, with a one-off reversal of benefits of INR160m; employee costs are expected to remain flat in the upcoming quarters.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412