Add IndusInd Bank Ltd For Target Rs. 875 By Emkay Global Financial Services

We downgrade IndusInd Bank (IIB) to ADD from Buy, slashing our TP by ~22% to Rs875. This follows IIB hosting an analyst call on 10-Mar-25 to discuss the impact of huge accounting discrepancies observed in its forex derivatives portfolio which is expected to have an adverse impact of 2.35% on its net worth as of Dec-24 (post tax: ~Rs15.8bn). This is based on preliminary findings, and the final impact may vary following completion of the external audit in Q4FY25.

Past accounting discrepancies in forex derivatives to hit FY25 RoA and NW

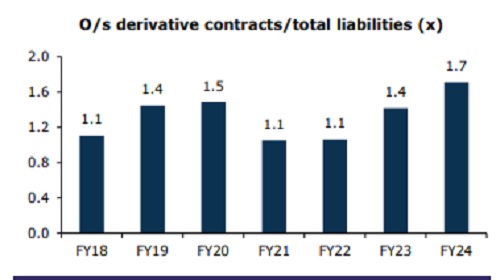

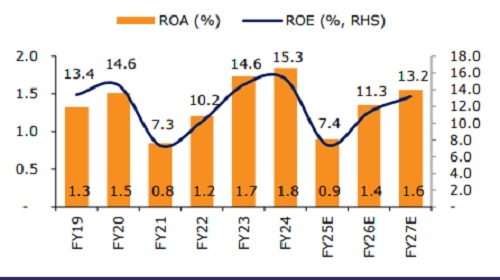

As per RBI directives on investments issued in Sep-23, banks are prohibited from conducting internal trades/hedging and, accordingly, IIB too ceased internal trades wef 1-Apr-24. However during an internal review, the bank identified certain discrepancies where accounting of losses on forex derivatives/swap transactions executed prior to Apr24 (over the past 5-7 years) to hedge forex deposits/debt via prop-desk (not related to clients) were not recognized through NII, while the corresponding treasury gains were recognized in the P&L. These accumulated losses (pre-tax @Rs21bn and post-tax @Rs15.8bn) are estimated to have an adverse impact of 2.35% on its networth (NW) as of Dec-24. IIB clarified that it shall take the hit through P&L (below PPoP) which, coupled with accelerated provisions on the MFI portfolio, shall push the bank into losses during Q4FY25 and drive down the FY25E RoA by ~30bps to 0.9%, in our view. The bank has hired an external agency to review and validate the findings, and had intimated the RBI a week ago about its preliminary findings. Notably, the ex-CFO (who resigned in Jan-25) was also aware of this accounting discrepancy.

Current MD assures to stay for one year; expect MFI stress to peak in Q4FY25

The management indicated that MFI stress is likely to be elevated in Q4FY25, as also the credit cost, which we believe could be due to the continued impact of MFIN guardrails and the recent ordinance in Karnataka disrupting collection efficiency, even that of registered lenders. That said, we believe the MFI stress could spill into Q1FY26 as well, and thus normalization shall be expected Q2FY26 onward. On the shorter-term extension by the RBI, the MD indicated that the regulatory decision could possibly have been influenced by his style of working. Nonetheless, he remains committed to completing his one-year term amid fear of earlier resignation and thus ensure smooth transition to the new management, as per the decision by the company Board.

We downgrade to ADD from Buy with revised down TP of Rs875

Given the back-to-back adverse events, including shorter term for MD and unveiling of past accounting discrepancies impacting FY25 RoA/NW, we cut our TP further to Rs875 from Rs1,125, now valuing the bank at 1x FY27E revised ABV (earlier 1.2x). We believe the stock should react adversely in the near term, to the recent events as well as to the elevated stress in MFI and hence remain under pressure. However, we recommend ADD from the medium-to-long term perspective, taking comfort from the reasonable valuations for a bank capable of delivering higher RoA (1.4-1.6%) over FY26-27E as the asset quality tide takes a turn for the better.

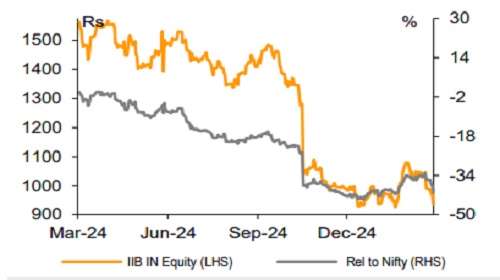

1-Year share price trend (Rs)

Exhibit 1: IIB has historically had high derivative exposure vs other banks

Exhibit 2: We expect healthy RoA of 1.4-1.6% over FY26-27E, once the MFI stress eases

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)