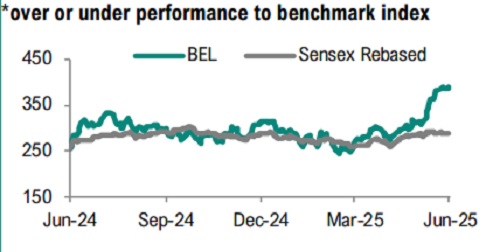

Buy Bharat Electronics Ltd For Target Rs. 441 By Geojit Financial Services Ltd

A strong Q4, led by margin expansion

Bharat Electronics Ltd. (BEL) is a Navaratna enterprise with a 37% market share in Indian defence electronics. BEL’s core capabilities are in radar & weapons systems, defence communication & electronic warfare.

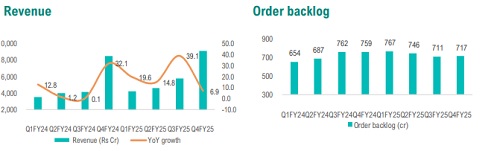

• Revenue grew by 7% YoY in Q4FY25, while net profit recorded an 18% YoY increase, exceeding our expectations.

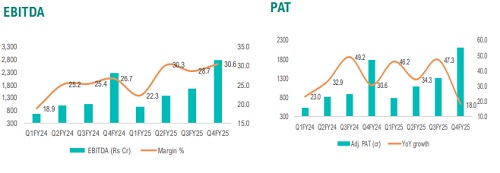

• EBITDA grew by 22.3% YoY, and margin was up by 380bps YoY to 30.6%, led by a better product mix and lower cost.

• FY25 order backlog was at Rs.71,650cr (3.0x FY26E sales), providing strong visibility for the next 3 years. Order intake for FY25 was at ~Rs.19,400cr, and was marginally lower than initial guidance.

• For FY26, management guided revenue growth of 15% YoY, EBITDA margins of 27% with an order inflow guidance at Rs.27,000cr.

• BEL’s margin guidance appears achievable, supported by rising indigenous content. A strong order pipeline enhances the long-term outlook. We forecast earnings to grow at a 20% CAGR over FY25–27E.

Outlook & Valuation

We maintain a positive outlook on Bharat Electronics Limited (BEL), supported by the government's strong emphasis on domestic manufacturing, the growing contribution of electronics in defense applications, BEL’s established market leadership, a robust order backlog, and a consistently healthy margin profile. Considering the upgrade in our earnings estimates and potential large order inflow in FY26, we value BEL at a P/E of 42x FY27E EPS and maintain a BUY rating, with a target price of Rs.441.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

.jpg)

.jpg)