Add Petronet LNG Ltd For Target Rs. 325 By Yes Securities Ltd

In line volumes; EBITDA marginally better on higher inventory gains

Our View

Petronet LNG's Q3FY25 revealed a strong performance with EBITDA and PAT experiencing an increase of 13.8% and 17.4% YoY on higher gains despite higher opex. The regas volumes saw a decline of 1.7% YoY to 228tbtu. Dahej terminal continued to play a crucial role in India's LNG imports, accounting for about ~67% of the total and having ~96% Dahej terminal utilization. The company has provisioned Rs 7.02bn of Use-or-Pay (UoP) charges as a matter of accounting prudence during Q3FY25. We upgrade the stock to an ADD rating due to the stock price correction, with a revised TP of Rs325, valuing the stock at 11x PER.

Result Highlights

* Performance: Petronet’s adjusted revenue was down 13.5% YoY and 6.1% QoQ, to Rs122.3bn; its EBITDA was up 13.8% YoY and 3.9% QoQ, to Rs12.5bn; its PAT was up 17.4% YoY and 2.3% QoQ, to Rs8.7bn. The other expenses at Rs 3.5bn; were down 5% YoY but up 6% QoQ. Overall volumes are in line to our estimate, EBITDA and PAT are higher than our estimates due to high than expected inventory and trading gains.

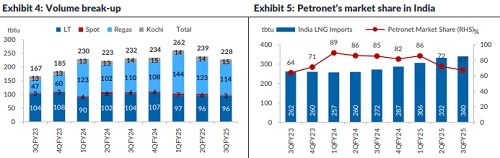

* Volumes: The total re-gasified volumes were down by 1.7% YoY and 4.6% QoQ, to 228tbtu, of which 213tbtu was from Dahej (at ~96% utilization), 15tbtu from Kochi (at 23.6% utilization). In terms of volume break-up, Dahej’s 96tbtu is longterm, down 7.7% YoY and flat QoQ, spot 3tbtu and Service 14tbtu, down 2.3% YoY and 5.3% QoQ.

* Market Share: India imported ~340tbtu of LNG (as per PPAC volumes) in the quarter, improved sequentially on stronger gas demand across sectors, except power which declined. Petronet’s share was at ~67% despite stronger Dahej terminal utilization (72% the quarter prior, 85% a year ago).

* Provisions: Total UoP charges stand at Rs16.66bn, with Rs7.02bn provisioned. Of the balance, Rs3.6bn for CY21 is due, Rs6.95bn for CY22 is outstanding, and Rs6.1bn for CY23 is recoverable by Dec'26 against guarantees. Rs1.17bn was recovered this quarter.

* The gross margin was Rs73/mmbtu; Opex was higher at Rs 18.3/mmbtu while EBITDA was Rs54.7/mmbtu (versus our expectations of 51.4).

* 9MFY25 performance: Overall volumes was at 729tbtu vs 685tbtu in 9MFY24 was up 6.4% YoY. Dahej volumes at 686tbtu (at ~103% utilization) was up 6.4% YoY; Kochi at 43tbtu (at 22.6% utilization) up 7.5% YoY. EBITDA at Rs 40.1bn versus Rs 34.9bn in 9MFY24; PAT at Rs 28.6bn vs Rs 23.5bn in 9MFY24.

Valuation

We believe earnings would record a ~7.8% CAGR over FY24-27e, driven by the Dahej utilization and a further ramp-up at Kochi. Large capex under way with Dahej expansion, a greenfield LNG terminal at Gopalpur and foray into petchem which would be the key to monitor as cash on books would be utilized for the same. Long term takeor-pay contracts end in 2036 and Rasgas sourcing contract in 2048, leading to stable long-term volumes. Kochi capacity ramp up was delayed due to lack of evacuation pipeline; however, it has been completed while Kochi-Bengaluru pipeline is still in progress. Dahej and Kochi terminals current capacities are 17.5/5mtpa and the contracted volumes at Dahej/Kochi Terminal are 15.75/1.44mtpa, would lend key support. We expect that petchem margins could be weak and would impact the returns. We upgrade the stock to an ADD rating due to the stock price correction, with a revised TP of Rs325, valuing the stock at 11x PER.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632