Buy Federal Bank Ltd For Target Rs. 225 By Yes Securities Ltd

New management makes prudential moves

Our view – Wholesale deposits curbed and provisions accelerated

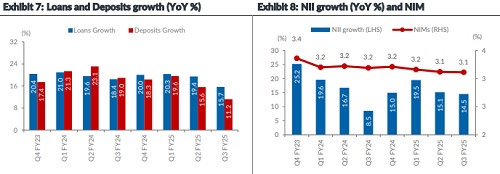

Balance sheet growth – New management seems to pull back from a relatively recent rise in wholesale deposit dependence, which had allowed faster loan growth: Total deposits were at Rs. 2,664 bn, down by -1.0% QoQ but up 11.2% YoY. The bank has made a pivotal decision that growth based on high-value deposits is not for them. Wholesale term deposits, specifically above Rs 30mn, were down by Rs 40bn QoQ to Rs. 338.48bn. Management stated that, while the bank gave up some growth during the quarter, it will try to strike a balance between growth and reorientation. Following re-orientation, the bank will typically target growing at 1.5x the system level growth.

Asset Quality – Slippages remained well under control but management adopted industry best practice on provisioning policy leading to upfronted provisions: Gross NPA additions amounted to Rs. 4.98bn for 3QFY25 (Rs 4.34bn in 2QFY25), translating to an annualized slippage ratio of 0.85% for the quarter. Provisions were Rs 2.92bn, up by 85% QoQ and 221% YoY, translating to calculated annualised credit cost of 51bps. Almost all of the provision was an accelerated provision worth Rs 2.92bn on account of benchmarking the bank’s provisioning practices to the best in the industry. The credit cost guidance for full year FY25 is 40-50 bps and beyond FY25, it is 40-45 bps.

Net Interest Margin – Margin was broadly stable sequentially and there was no dependence on any one-off: NIM was at 3.11%, down -1bp QoQ and -8bps YoY. Management has decided to make a material shift from floating rate to fixed rate loans. Unsecured retail and microfinance remains below 5% of overall loan book and management is currently cautious but will grow share in the medium term. There will also be a focus on medium-yield loans which, along with focus on average CASA, allows management to guide for stable margin

We maintain ‘BUY’ rating on FED with a revised price target of Rs 225: We value the standalone bank at 1.4x FY26 P/BV for an FY25/26/27E RoE profile of 12.6%/13.8/15.0%. We assign a value of Rs 11 per share to the subsidiaries, on SOTP.

(See Comprehensive con call takeaways on page 2 for significant incremental colour.)

Other Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio was at 53.1% up by 11/125bps QoQ/YoY and the Cost to assets was at 2.1% down by -2bps both QoQ and YoY

* Fee income: Core fee income to average assets was at 0.8%, down/up -3/4bps QoQ/YoY

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

.jpg)