Buy Apeejay Surrendra Park Hotels Ltd for the Target Rs. 235 By Prabhudas Liladhar Capital Ltd

Double-digit RevPAR growth in a subdued quarter

Quick Pointers:

* Acquisition of Zillion, Juhu completed with opening scheduled by end of 2026

* Approval granted by KMC at EM Bypass, Kolkatta. Project ready for launch in Jan-26

We cut our EPS estimates by ~4% for FY27E/FY28E as we fine-tune storeopening timelines for Flurys and realign our tax rate assumptions. PARKHOTE IN reported healthy operating performance with EBITDA beat of 4% led by double-digit growth in RevPAR while bottom-line was marred by a higher tax rate of 41.9% (PLe 30%). While PARKHOTE IN intends to open 30 outlets for Flurys in FY26E now versus an earlier target of 40; there was visible traction on the hospitality side as a) acquisition of Zillion Hotels, Juhu got culminated, b) approval was granted by KMC for the mixed-use project at EM Bypass, Kolkatta. We expect sales CAGR of 17% over the next 3 years driven by addition of 258 hotel rooms and 120 outlets of Flurys with an EBITDA margin of 33.1%/33.5%/36.3% in FY26E/FY27E/FY28E respectively. We maintain BUY with SoTP based TP of Rs235 valuing hotel business at 15x Sep-27E EBITDA (no change in target multiple) and Flurys at 3x Sep-27E sales (no change in target multiple).

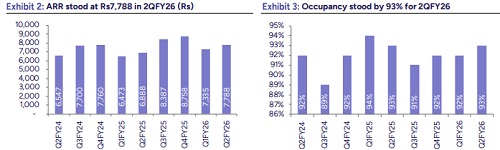

RevPAR increased 11.9% YoY: Revenue increased 16.8% YoY to Rs1,654mn (PLe Rs1,510mn). Hotels/Flurys revenue grew 16.3%/21.4% YoY to Rs1,484mn/170mn respectively. ARR increased 13.1% YoY to Rs7,788, occupancy stood at 93.0%, translating into a RevPAR of Rs7,204 which grew 11.9% YoY.

EBITDA margin stood at 29.6%: EBITDA increased 17.9% YoY to Rs490mn (PLe Rs473mn) with a margin of 29.6%. PAT declined 39.4% YoY to Rs162mn for the quarter. Adjusting for a one-time expense of Rs1.5mn, PAT increased 7.2% YoY to Rs164mn (PLe Rs189mn) with a margin of 9.9%. PAT was lower than our estimate on account of higher tax charge of Rs116mn (PLe Rs81mn).

Con-call highlights: 1) ARR grew 13.1% YoY to Rs7,788 led by strong pricing across Chennai, Delhi, Bengaluru and Kolkata. 2) 588 new keys are expected to be added in 2HFY26E, with 31/144/~400 keys across owned/leased/managed categories respectively. 3) New openings are phased across 2HFY26E as follows: - Goa (42 keys + another 9 keys villa), Kochi (31 keys), and 102 managed keys scheduled for Nov–Dec’25, followed by ~70 keys in Jan’26, ~100 keys in Feb’26 and 243 keys in Mar’26. 4) PARKHOTE IN has completed the acquisition of Zillion Hotels, Juhu (Mumbai) which will be converted into an 80-room super-luxury boutique hotel, scheduled to open by end of 2026. 5) For the E.M. Bypass, Kolkata project, all government approvals have been secured, and groundbreaking is scheduled for Jan’26. 6) PARKHOTE IN has ~1.5mn sq. ft. of FSI land bank, offering substantial scope for future development. 7) The plan is to add 30 outlets for Flurys in FY26E with an aim to reach 200 outlets by FY27E. 8) EBITDA margin for Flurys is in highsingle-digit 9) Incurred capex of Rs1,883mn in 1HFY26E, with majority being earmarked towards acquisition of Zillion. 10) Rs150mn invested towards automation.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271