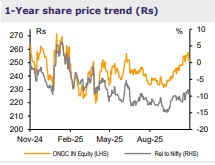

Add ONGC Ltd for the Target Rs.280 By Emkay Global Financial Services Ltd

Stable numbers; downgrade to Add on oil volatility

We downgrade ONGC to ADD from Buy, while retaining Sep-27E TP of Rs280 (~7.5x consol target P/E), with value of listed investments now higher. ONGC’s Q2FY26 SA EBITDA of Rs166.0bn missed our estimate by 2% albeit on higher forex loss, while PAT of Rs98.5bn beat our estimate by 2% on lower tax rate due to dividend income. Survey and Dry Wells costs were lower at Rs11bn vs Rs13bn estimated. Total crude production rose 0.6% YoY to 5.2mmt (inline), while gas production fell 0.6% YoY to 5.0bcm (1% miss). NWG contributed to 21% of NB gas revenue in H1. KG 98/2 crude production fell to 28kbpd. The mgmt is optimistic about output growth from Q4FY26, backed by green shoots from BP TSP, 98/2 gas ramp up as key facilities get installed, and increased production from Daman. It should see full impact from these assets in FY27 and Daman qualifying as NWG. ONGC also targets Rs50bn opex savings over time – started taking initiatives. We lower FY26-28E SA EPS by 9-13% each, building in lower Brent price (USD65/bbl), though partly offset by weaker currency.

Result Highlights

ONGC’s SA revenue of Rs330bn was largely in-line. Nominated+NELP block crude production rose 1.1% YoY to 4.88mmt, while JV fell 6% to 0.31mmt. For gas, NB+NELP was flat YoY at 4.92bcm, while JV declined 19% to 0.11bcm. VAP production was flat YoY at 0.63mmt (6% miss). Oil realization in Q2 was in line at USD67.3/bbl, while gas realization was flat QoQ at USD7.6/mmbtu. Total production cost was 5% above our estimate as other expenses were 5% higher at Rs69.1bn, due to forex losses of Rs11.5bn. DD&A declined 2% QoQ to Rs63.7bn, while finance cost was down 1% QoQ at Rs11.1bn. Other income at Rs34.2bn was down 28% YoY (1% miss). OVL’s Q2 consol EBITDA rose 131% QoQ to Rs10.8bn, on 41% QoQ uptick in crude realization, while unit opex declined 10% to USD8.5/boe. OVL’s crude/gas production fell 6%/14% YoY and 2%/13% QoQ in Q2. Despite the unplanned plant shutdown (utilization at 78%), OPaL reported positive EBITDA of Rs2.1bn vs Rs70mn loss QoQ and Rs254mn profit YoY, while net loss reduced to Rs4,6bn. ONGC’s Board declared an interim dividend of Rs6.0.

Management KTAs

KG-98/2 gas output should reach 10mmscmd peak by Jul-26, while that at Daman should hit 5mmscmd in FY27. FY26 oil/gas production guidance is lowered to 19.8mmt/20bcm. DSF should come by Q4FY27, with full impact of the ~4mmscmd output by FY28. A major technical part of the BP TSP is under works, and full-fledged effect would be seen starting Jan-27. NWG share was ~13% in Q2, though should reach 30-35% in 3-4Y due to Daman and DSF. Opex savings are through shifting logistics to Pipavav, chopper operations from Surat, using bigger vessels, etc. OPaL’s EBITDA should remain positive in H2FY26.

Valuation

We value ONGC on DCF-based SOTP, comprising SA (incl KG98/2) and OPaL. Investments are valued at our TP/CMP, with 30% holdco discount. Key risks: adverse oil-gas prices, policy issues, local tensions, cost overruns, outages, OFS, and dry holes.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354