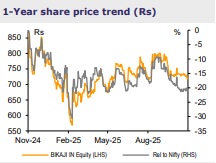

Buy Bikaji Foods International Ltd for the Target Rs.950 By Emkay Global Financial Services Ltd

Robust Q2 show; tailwinds in place for faster growth ahead

We maintain BUY on Bikaji with Sep-26E target price of Rs950 (on 65x P/E), supported by the company’s continued progress toward its goal of becoming a ‘Total Food Company’. Q2FY26 performance was better than expected, with inline revenue growth of 15%, while adj PAT growth stood at 18% – 7% better than expected. Overall revenue growth was aided by a healthy 32% growth in packaged sweets and 77% growth in exports. We estimate a ~4% impact on revenue growth in Q2 (largely in ethnic snacks) with the GST transition. We see GST tailwinds helping revenue growth ahead; simultaneously, we see healthy earnings delivery in 2HFY26E, on a weak 2HFY25 margin-base.

Strong recovery in packaged sweets and exports aids Q2 revenue growth

Bikaji has reported consolidated revenue growth at 15% with 11% volume growth, both in line with our expectations. We estimate 4% impact on revenue from the GST-related transition. Its Ethnic snacks portfolio saw 4.6% YoY growth, and revenue salience reduced by 640bps YoY to 59%. Adjusted for the GST transition, the ethnic portfolio is likely to have seen a high single-digit growth. Sales of packaged sweets surged 32%, with festive concentration in Q3; revenue salience expanded by 250bps YoY to ~20% in Q2. Other revenue, relating to comprising frozen snacks and ancillary products, is estimated to have grown ~79% YoY to Rs604mn in Q2. Core markets (~64% of revenue; down by 460bps YoY) have seen a relatively softer growth at ~6%, while ‘focus’ (steady at 15.5% of revenue) and ‘other’ (14% of sales) states saw 12% and 35% growth, respectively. Exports revenue (6.5% of sales) grew 77% YoY to Rs511mn. Family pack (66% of revenue, up by 320bps YoY) sales grew 18.8% (aided by packaged sweets), while the impulse pack saw a muted 3% growth. Standalone revenue grew 11% YoY. We estimate 54% YoY revenue growth in The Hazelnut Factory to ~Rs200mn. Bikaji’s retail operations are likely to have achieved revenue of Rs80mn in Q2FY26E.

Better margin delivery aided a 20% reported EBITDA growth in Q2FY26

Gross margin, adjusted for PLI benefits of Rs125mn in Q2, improved by 200bps YoY and 25bps QoQ to 34.1%. Amid key raw materials, Pulses and flours saw 15% YoY deflation, while palm oil saw 24% inflation. EBITDA margin (ex PLI) saw a 50bps expansion YoY to 14.2%. Reported EBITDA grew 20% YoY, while growing 26% YoY adjusted for PLI. Adjusted PAT grew 18% YoY to Rs808mn, while growing 25% YoY adjusted for PLI. The company logged exceptional loss of Rs43.5mn, on account of a fire incident in one of the 3P facilities.

GST tailwinds to aid demand; low base to aid earnings in 2H; maintain BUY

We expect Bikaji to continue seeing enhanced execution, which has helped the company post a better Q2 show. For the core business, we expect mid-teen growth – possible, if the company sustains its market expansion. As optionality gains strength, we see longevity of its double-digit growth trend.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)