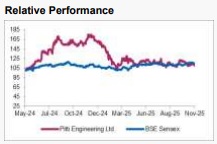

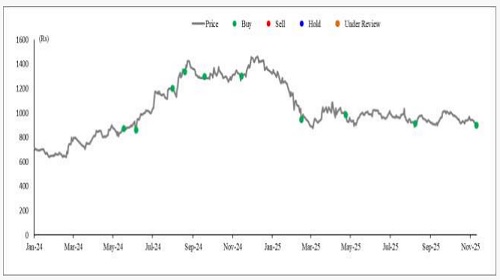

Buy Pitti Engineering Ltd For Target Rs. 1,335 - Axis Securities Ltd

Decent Quarter, Ramp-up Expected Q4FY26 Onwards

Est. Vs. Actual for Q2FY26: Revenue - Largely INLINE; EBITDA - INLINE; PAT - BEAT

Changes in Estimates Post Q2FY26 Result

FY26E/FY27E: Revenue: 0%/0%; EBITDA: 0%/0%; PAT: -5%/-5%

Recommendation Rationale

* Robust Volume Expansion Across Core Segments: PEL delivered a resilient performance with revenue and EBITDA rising 11% and 18% YoY, respectively, reflecting strong execution despite a challenging macro environment. Backed by healthy demand across key end-user industries, the company was able to deliver around 6% volume growth and expressed confidence in reaching the targeted volume growth of 10% in FY26. During the quarter, capacity utilisation stood at 90% for machined hours, 76% for sheet metal, and 77% for casting. PEL expects to see a ramp-up in capacity utilisation from Q4FY26, which shall further drive the volume growth.

* EBITDA Margins Improve Despite Supply-side Issues: The company continued to face challenges related to the supply of electrical steel and has started importing material from Japan and Korea. Despite this, PEL delivered 18% YoY EBITDA growth during the quarter, with an 87 bps improvement in margins. Gains were driven by better operating leverage from increasing volumes and ongoing cost optimisation measures.

* Eyes On Next Leg of Growth: As the current capacities are close to optimum utilisation, the company is planning to make a capital investment of Rs 150 Cr towards capacity expansion to meet the anticipated increase in demand. This capacity expansion is expected to be executed in stages, reaching peak levels by the end of FY27. PEL is also strategically working with customers to increase its contribution to the overall value chain. The management also mentioned that there is a major opportunity arising in the data centre space, and PEL is working on realigning the capacities to cater to the anticipated increase in demand. The management is also open to inorganic growth opportunities in the related sectors to drive the growth beyond FY28.

Sector Outlook: Positive

Company Outlook & Guidance: The company continues to see sustained order inflow and steady demand globally as well as domestically from sectors like traction motors, railway, components, data centres, and renewable energy sectors. The company is working with customers to increase the wallet share by providing value-added products and is exploring growth opportunities in the rising data centre sector. The management expects a significant ramp-up in volumes from Q4FY26, and expressed confidence in meeting the FY26 volume growth target (with the possibility of exceeding the same).

Current Valuation: 22x Sept’27E EPS (Earlier Valuation: 25x FY27E EPS)

Current TP: Rs 1,335/share (Earlier TP: Rs 1,350/Share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

PEL reported Q2FY26 revenue of Rs 478 Cr, up 11% YoY and 5% QoQ, broadly in line with estimates. Capacity utilisation remained strong across operations. Sales Volume registered healthy growth across key product categories in Q2 and H1FY26. EBITDA came in at Rs 78 Cr, rising 18% YoY and 3% QoQ, also in line with our expectations. EBITDA margin stood at 16.3%, an improvement of 87 bps YoY. PAT was Rs 40 Cr, up 5% YoY and 75% QoQ.

Outlook

The company remains on track to achieve its FY26 and FY27 guidance. Steady demand from key end-user industries, despite short-term fluctuations, is expected to drive improved utilisation levels. Recently announced capacity additions will further support revenue growth in FY27 and beyond, with a meaningful earnings contribution from FY28. Revenue growth is expected to remain robust, supported by margin improvement as economies of scale strengthen and the share of value-added products increases over time.

Valuation & Recommendation

We marginally tweak our FY26E/FY27E estimates and roll forward the estimates to FY28E. These estimates take into account the capacity expansions and anticipated volume growth. We value the stock at 22x Sep’27E EPS and with a revised target price of Rs 1,335/share, implying an upside of 48% from the CMP. We believe the current valuation levels provide a good opportunity, as the company’s long-term growth prospects remain strong, and we maintain our BUY rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633