Buy Welspun Living Ltd For Target Rs. 170 - Axis Securities Ltd

Est. Vs. Actual for Q4FY25: Revenue: INLINE; EBITDA: BEAT; PAT: BEAT

Change in Estimates post Q4FY25

FY26E/FY27E: Revenue: -2%/-2%; EBITDA: 7%/3%; PAT: 4%/3%

Recommendation Rationale

Flooring Continues to Disappoint: The company’s Flooring division continues to face headwinds, with revenue for the quarter coming in at Rs 196 Cr, down 8% YoY and 9% QoQ, marking the second straight quarter of decline. The business faced challenges due to Red Sea disruptions, which affected transit times in Q3, along with ongoing uncertainty surrounding US tariffs that weighed on performance. However, management remains optimistic about recovery in the coming period, supported by strategic focus on the US Home Improvement, expansion in the Middle East, Australia and New Zealand, and UK FTA-driven growth.

Strategic Business Buildup Continues: The company has been consistently expanding its market share in emerging and Branded Business segments, which is expected to contribute to future margin improvements. On the domestic front, Welspun remains focused on strengthening its brand presence. Emerging business verticals, including Domestic Consumer, Global Brands, and Advanced Textiles & Flooring, contributed 30% to the total revenue.

India-UK FTA – A Structural Positive: On a positive note, the announcement of the India-UK Free Trade Agreement (FTA) is seen as a major catalyst for the Indian home textile industry. With this agreement, India gains a level playing field with regional competitors like Pakistan and Bangladesh in the UK market. Given India’s scale, competitiveness, and political stability, the company is optimistic about leveraging this agreement to strengthen its presence in the UK.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: In light of the dynamic and uncertain external environment, the management has indicated that issuing definitive guidance for FY26 remains challenging at this stage. The company continues to closely monitor ongoing developments and intends to provide a more concrete outlook once greater clarity emerges. Despite the near-term uncertainty, the company reaffirms its long-term revenue target of Rs 15,000 Cr by FY27, acknowledging the possibility of minor timing deviations. Additionally, it continues to aim for EBITDA margins in the range of 15–16%, inclusive of other income, over the long term.

Current Valuation: 12x FY27E (12x FY27E)

Current TP: 170/share (165/share)

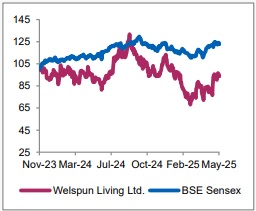

Recommendation: We maintain our BUY rating on the stock with an upside potential of 16% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633