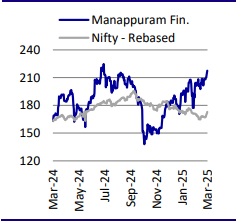

Neutral Manappuram Finance Ltd For Target Rs. 240 By Motilal Oswal Financial Services Ltd

Bain Capital’s acquisition of joint control a healthy development

Mandatory open offer of 26%; reconstitution of the Board and management

Bain Capital will invest ~INR43.85b in MGFL to acquire ~18% stake on a fully diluted basis through a preferential allotment of equity shares and warrants at INR236/share (~30% above the six-month average trading price and ~9% higher than the CMP).

* The transaction will trigger a mandatory open offer for the purchase of an additional ~26% stake in the company on an expanded capital basis (excluding warrants). The open offer price has been fixed at INR236/share.

* After the completion of this transaction, Bain Capital will acquire ~18%- 41.7% stake in the company on a fully diluted basis, depending on the open offer uptake. Meanwhile, the stake of existing promoters will decline to 28.9% on a fully diluted basis (from ~35.3% held currently).

* Following the transaction’s completion, Bain Capital will be classified as a promoter of the company and jointly control MGFL with existing promoters. Additionally, Bain will have the right to materially influence strategic decision-making, at MGFL as the Board will be reconstituted to include two nominee directors of Bain Capital.

* The transaction is expected to close by 2Q/3QFY26, subject to the receipt of necessary approvals.

Structure of transaction with Bain Capital

* Bain Capital’s equity investment will consist of two parts: a) A preferential allotment of equity shares amounting to INR21.92b at INR236/share and b) A preferential allotment of warrants, convertible into equity shares, for an aggregate investment of INR21.92b at INR236/share, which may be exercised and converted in one or more tranches during the period commencing from the expiry of four months until 18 months from the date of allotment of warrants.

* Existing promoters will hold a ~28.9% stake in the company post the investment on a fully diluted basis (including shares to be issued upon the exercise of warrants).

MGFL 2.0: Bain Capital to lead strategic transformation with current promoter transitioning to non-executive role

* Bain Capital has a track record of scaling and running businesses in partnership with existing promoters in India. Notable past partnerships include 360 One WAM, L&T Finance, and Axis Bank in the financial services sector

* MGFL 2.0 will be a professionally managed company, operating under the strategic leadership of a new CEO. Bain Capital will have the right to nominate members of the Executive Management, including the CEO and key managerial personnel, for MGFL and its group companies.

* Under the new leadership, the company will aim to fast-track its growth in gold loans by leveraging strong market position. It will also accelerate the expansion of its mortgage and vehicle finance businesses while ensuring continued growth in MFI with stronger risk management and collections.

* The company will continue investing in technology and analytical capabilities to drive cross-selling and product innovation.

* As mentioned earlier, the Board of MGFL will be reconstituted to include two Nominee Directors from Bain Capital. The current promoter, Mr. Nandakumar, will continue to guide the team in his role as the Non-executive Chairman and Mentor.

* MGFL plans to utilize the fresh equity capital for onward lending, investment in subsidiaries, and general corporate purposes

Bain Capital to spearhead MGFL’s next phase of growth

* Bain Capital’s investment and acquisition of joint control will enable it to spearhead the next phase of growth in MGFL’s core segments, supported by a well-structured strategic plan for the next 4-5 years.

* It will help MGFL leverage its strong foundation in gold loans and accelerate its growth in other high-potential segments. The company will look to build a professional management team, with Mr. Nandakumar stepping into the Nonexecutive Chairman and Mentor role going forward.

* With the acquisition of the joint control, Bain Capital will have the right to materially influence the strategic decision-making at MGFL.

Valuation and view

* This substantial capital infusion is expected to strengthen MGFL’s financial position, enabling the company to enhance operational efficiencies and expand its footprint across its key segments, including gold loans, vehicle finance, MSME lending, and microfinance. The joint control of Bain Capital will provide strategic guidance and expertise, facilitating the company's next phase of growth.

* Onboarding a strategic investor and granting joint control for the company’s next phase of growth is a positive step, especially considering the limited visibility on succession planning (more from a business perspective rather than just as a promoter). However, we will still need to monitor the execution under Bain Capital’s control as it will have to navigate the deeply ingrained processes and cultures at MGFL to successfully deliver a turnaround. The first step in this direction will be to identify and appoint a professional CEO (for MGFL standalone and, where needed, for its group companies), who can then build a strong senior management team.

* After incorporating the total equity investments by Bain Capital over FY26 (and FY27), MGFL currently trades at 1x FY27E P/BV and 7x FY27E P/E. While valuations are indeed attractive, what will be important for a re-rating (beyond the open offer price of INR236/share) is for investors to gain greater confidence in this strategic transformation attempt at MGFL. We maintain our Neutral rating on the stock with a TP of INR240 (based on 1.1x Mar’27E consolidated BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412