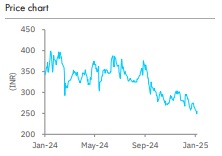

Buy Rites Ltd For Target Rs. 325 By Elara Capital Ltd

Orderbook surges amid muted quarter

RITES (RITE IN) saw another quarter of YoY decline despite sequential improvement in sales and margin due to delay in exports execution to H2FY26 and a drop in consultancy & turnkey segments. However, record order inflows during the quarter have led to an orderbook of INR 79bn. We lower our TP to INR 325 (from INR 365) due to delayed execution in exports and lower margin, given the rise in competitive bidding. But we reiterate Buy as the stock has fallen 14% vs the Nifty’s 5% in the past three months. A rebound in exports with robust order inflows makes RITES a favorable play in infrastructure.

FY25 may witness YoY decline; FY26 could see strong rebound:

Q3 revenue saw a decline of 16% YoY to INR 5.6bn, led by a revenue drop in consultancy & turnkey segments and delayed execution of exports to FY26. Management expects FY25 to see a ~10% YoY decline in top line and ~20% YoY fall in profitability due to a challenging year; however FY26 is likely to witness a strong rebound with top line growing at least 20% YoY, led by execution of at least 40% of exports orderbook of INR 13bn in FY26, with the balance executed fully in FY27. Additionally, margin is likely to remain at 20-21%, due to the shift from nomination to competitive bidding in new orders.

Surge in order inflows in Q3, the highest in the recent past:

RITE saw a record surge in order inflows in Q3FY25 at INR 19.3bn, which is slightly lower than FY24 inflows of INR 22.0bn. This is the highest order inflows in the recent past, led by turnkey segment inflows, which grew 47x YoY, consultancy inflows doubling YoY, and leasing up 86% YoY. This takes orderbook to INR 78.6bn as on December 2024, up 22% QoQ. The company looks to win one exports order every quarter and reiterates guidance of one order win a day.

Current exports orderbook may be fully executed by FY27:

RITE looks to execute at least 40% of export orderbook in FY26, with the balance completely executed in FY27. This would be led by the Bangladesh rolling stock order, which may see revenue after H1FY26, and the Mozambique exports order also executed during Q2-Q3FY26. The Zimbabwe order still awaits funding approval from the African EXIM Bank; hence, it is yet to be booked in the orderbook. The new exports orders have a lower margin of ~10% from 20%, due to shift to competitive bidding on a nomination basis.

Reiterate Buy with lower TP of INR 325:

We lower our FY25E & FY26E EPS by 15% each and FY27E EPS by 17%, due to decelerating margin in consultancy and higher share of lower margin turnkey segment in orderbook. We lower our TP to INR 325 from INR 365 on 28x (unchanged) December FY26E EPS, due to delayed execution of exports to H2FY26 vs earlier guidance of Q4FY25. However, we retain Buy as the company has witnessed a record increase in order inflows during the quarter, along with exports rebound from FY26, and the stock having underperformed the Nifty by 8% in the past three months. We expect an earnings CAGR of 17% during FY24-27E with an average ROE and ROCE of 18% each during FY25-27E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933