Add JSW Steel Ltd For Target Rs. 1,048 By Yes Securities Ltd

Improving volumes and operational efficiencies help against margin contraction; Capacity expansions to fuel growth; maintain ADD!

Results Synopsis

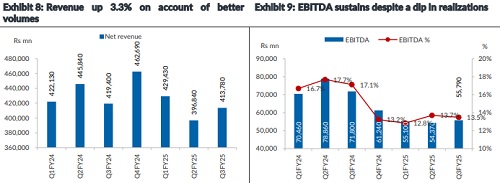

JSW Steel's Q3FY25 performance was marginally above the consensus expectations, primarily driven by strong volumes and effective cost management, which offset the declines in realizations (NSR). Net revenue from operations were up by 4.3% QoQ and marginally fell by 1.3% YoY, with EBITDA up 2.6% QoQ. This was on account of better volumes both on a consolidated and standalone level. A decline in coking coal costs of $34/t provided margin support, with an anticipated further $10-15/t reduction for Q4FY25 to bring in better cost efficiencies. The company is advancing its backward integration initiatives, expanding iron ore mining capacities in Karnataka, Odisha and Goa, while value-added products continue to hold a substantial 60% share of its product mix.

1.0 mtpa BPSL expansion complete. Focus shifts towards Vijayanagar, debottlenecking activities and Dolvi

JSW Steel’s current Indian capacity stands at 34.2 mtpa, with the ongoing 5.0 mtpa expansion expected to be fully ramped up by the end of FY25E. FY26E will see the BFIII at Vijayanagar go for relining and capacity enhancement (~1.5 mtpa). Furthermore, debottlenecking activities at Vijayanagar are anticipated to contribute an additional 0.5 mtpa, collectively driving meaningful volume gains over the course of the next year and a half.

We project production to grow from c.28 mt in FY25 to about c.33.2 mt by FY27E, at a CAGR of 8.5%. Sales are projected to grow alongside, moving from 26.5 mt to c.33.2 mt by FY27E. Altogether, it’s a significant capacity build-out that will continue to strengthen JSW Steel’s foothold in the Indian steel space.

Valuation and View

We project Revenue/EBITDA growth for JSW Steel at a CAGR of 15%/33%, over FY25-27E. We believe that the company's aggressive capacity expansion, combined with an anticipated recovery in steel prices from its bottom, positions JSW Steel in a ‘sweet spot’ to capitalize on growth opportunities within the Indian steel sector.

We value JSW Steel at 7.5x FY27E EV/EBITDA to arrive at our revised target price of Rs 1,048/sh.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632