Neutral Bajaj Auto Ltd For Target Rs. 9,479 By Yes Securities Ltd

Valuation comfort set in; catalyst yet to emerge

View – Margins expected to remain range bound

BJAUT’s 3QFY25 reported EBITDA was a marginal miss at Rs25.8b (est Rs27.3b) led by lower-than-expected ASPs at Rs104.6k/unit (est Rs109.4k/unit). EBITDA margins were flat YoY/QoQ at 20.2% led by; 1) stable gross margins at 28.7% (est 29%, flat YoY) led by benign RM. We continue to believe, margins likely to be range bound given positive impact of favorable mix (increasing share of premium ICE 2W and 3W), operating leverage to off-set by increased marketing spends coupled with higher share of EVs (even though PLI benefits have started to accrue). Further, co’s intended entry into largely unorganized E-rick segment (new launch in 4QFY25) to likely have near term margins dilution given fragmented and price sensitive customer segment.

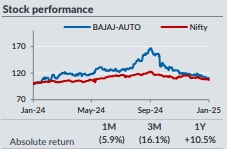

BJAUT continue to up the game in domestic EV as it targets volume ramp-up for Chetak as well as EV 3W, led by new launches and network expansion. This will further be supported by captive financing arm (BACL), with ~100% of BJAUT network covered already. The near-term focus is to 1) increase distribution for Chetak and EV 3W, 2) New EV 3W launch with large body variant in 4QFY25 for smaller/suburban towns as it targets to be full range player in EV 3W. BJAUT’s recent sharp derating in the recent past is on the back of dwindling market share in the domestic motorcycles segment. After the recent correction, however, the stock is trading at ~22.1x/19.6x FY26E/27E EPS to reflect on challenges but lacks re-rating catalyst. Therefor we maintain Neutral with TP of Rs9,479 (vs Rs10,201) at 22x Mar’27 EPS plus Rs76/share value of NBFC BACL. We cut FY26/27 EPS by 4-5% to factor in for lower volumes.

Result Highlights – Marginal miss on EBITDA, led by lower ASP

* Revenues grew ~5.7% YoY/-2.4% QoQ at ~Rs128.1b (est ~Rs134b) led by 2% YoY (flat QoQ) increase in volumes while ASP grew 3.7% YoY/-2.7% QoQ at ~Rs104.6k/unit (est Rs109.4k/unit). Spares revenues grew ~21% YoY at >Rs15b (highest ever). USD/INR at Rs84.3 in 3QFY25 (vs Rs83.8 QoQ and Rs83.2 YoY).

* Gross margins contracted ~20bp YoY (flat QoQ) at 28.7% (est 28.8%). Weak revenues restricted EBITDA growth of ~6.2% YoY/-2.7% QoQ at ~Rs25.8b (est Rs27.3b). Consequently, margins were flat YoY/QoQ at 20.2% (est 20.4%).

* Steady op. performance led to Adj. for this, PAT came in at ~Rs21.1b (+3.3% YoY/ -5.1% QoQ, est Rs22.6b, cons ~Rs21.7b). 9MFY25 S/A revenue/EBITDA/PAT grew 14%/17.4%/14% at Rs378.6b/Rs76.5b/Rs63.2b.

* Bajaj Auto Credit (BACL) performance - achieved profit in 3QFY25 at Rs520m. AUM is slightly above ~Rs70b. BACL rolled out across BJAUT's network ahead of schedule serving entire 2W and 3W range with ~70% share of financing.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632