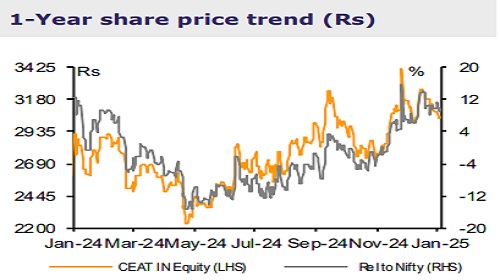

Buy CEAT Ltd For Target Rs. 4,000 By Emkay Global Financial Services

CEAT recorded accelerated revenue growth of 11% in Q3FY25 (~7.9%/1.5% volume /realization growth) with EBITDA ~5% above Consensus’, despite the ~60bps QoQ margin decline to 10.3% amid the ~1% higher RM. CEAT has guided to growth momentum continuing, with Truck/Bus, 2W, and Farm/PV replacement seen growing in a high single digit, double digits, and a low single digit, respectively, and further market share gains in consumer OEM categories along with sustained double digit growth in exports. While RM inflation remained ahead of price hikes in Q3FY25, RM is seen as largely stable (+/- 1%) in Q4FY25, with further price hikes on the anvil – including in 2Ws. CEAT expects to return to the higher-end of the 10-15% EBITDA margin band over FY26, if RM prices sustain at current levels. While margin recovery appears slightly delayed, we expect CEAT's consumer-facing product mix and continuing market-leading growth to cushion the impact. We cut FY25E/26E/27E EPS by ~8%/~4%/~2%, respectively, with bulk of the cut being attributable to higher than expected interest costs. We maintain BUY on CEAT, with unchanged TP of Rs4,000 at 18x Dec-26E PER.

Double-digit revenue growth; QoQ margin decline curtailed via strategic price hikes

Consol revenue grew 11% YoY to Rs33bn (above estimates) aided by 7.9%/1.5% volume/realization growth. EBITDA was down 6% QoQ to Rs3.4bn, but above consensus estimates. EBITDA margin declined by 63bps QoQ to 10.3%, with gross margin contraction restricted to ~59bps QoQ via active pricing actions partially offsetting the ~1.2% QoQ rise in natural rubber prices during the quarter. Adj PAT at ~Rs971mn was 5% below consensus’, amid higher than expected interest (due to higher average debt during the quarter) and tax expense.

Earnings call KTAs

1) The management has guided to continued growth momentum Q4, with the Truck/Bus replacement segment expected to grow in a high single digit, 2W replacement potentially in double digits, Farm/PVs replacement in a low single digits, and margin-accretive exports in double digits. 2) Growth is anticipated to relatively accelerate in the consumer OEM segments (2Ws/4Ws), amid market share gains through increased fitments; TBR segment to consolidate, despite a low single digit decline in MHCV volumes. On the rural front, the farm/2W replacement segment is seeing robust growth owing to favorable macros. 3) CEAT is inching toward double digit market share in a consolidated OHT market; PV segment market share has been largely stable over the quarters. 4) The US market is expected to contribute 20–30% of exports in the next 2–3 years, while the EU is nearing 10% of total turnover (in a single digit now). While LatAm faces headwinds, the US is seeing growth in OTR and TBR, with PCR introduction from FY26. The EU market is performing well in OHT. 5) CEAT aims to retain Camso’s premium positioning and pricing, targeting customers in international (EU and US) markets; OHT segment revenue contribution would nearly double (~15% now), with share of exports growing to ~26% (vs 19% now) post consolidation of Camso in Q1FY26. 6) In Q3, CEAT took price hikes across categories in the replacement segment – 1.5% in Farm/CVs and 4% in PVs; further hikes are planned in the export and replacement segments in Q4; owing to robust growth and higher competition in 2Ws, price hikes were restricted to ~1% (at the end of Q3; would continue in Q4FY25); further 5-6 price hikes would be needed to close the pricing gap in 2Ws; price hikes to be enforced in 3Ws by end of Jan-25. CEAT has secured 3–4% price benefit in indexed OEMs and negotiated additional increases with CV OEMs. 7) Business mix improvement and price increases were insufficient to offset the 1.2% QoQ RM inflation in Q3, and RM costs are expected to be flattish (+/-1%) QoQ, contingent on crude prices and currency depreciation; The management expects to reach the higher end of the 10-15% EBITDA margin band over FY26, given that RM prices remain stable at current levels as it would take ~6-9 months to pass-on any price increase. 8) The proposed 30% capacity expansion of 2W/3W tyre capacity to 35mn tyres pa (vs 27mn now) would entail a capex of ~Rs4bn, with completion targeted for FY28. This would be funded by a mix of internal accruals and debt. PCR/TBR capacity at the Chennai plant is also under discussions. However, the management has maintained its guidance of bite-size capex of ~Rs10.5bn for FY25. 9) Overall utilization levels remain above 85%, with the Halol plant functioning at 95% utilization. 10) Working capital / debt has reduced by Rs840mn/500mn in Q3; net debt/EBITDA stands at 1.22x, and net debt/equity at 0.43x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354