Add ABB India Ltd For Target Rs. By Emkay Global Financial Services Ltd

Execution mix, order inflow key near-term monitorables

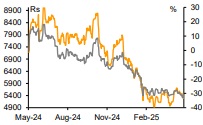

We maintain ADD on ABB India (ABB IN) with TP of Rs6,100 (unchanged). ABB India witnessed muted revenue performance in Q1CY25, due to slow pace of execution amid change in mix. Margin continued to be stable at ~18%. Order inflow came in at Rs37.9 bn (+4% YoY), partially helped by spillover of an order from Q4CY25. Order backlog at the end of Q1CY25 stood at Rs100bn, up 11% YoY. The management indicated delays in finalization of large orders. However, base orders are likely to grow, given the highly diversified end markets and their increasing penetration into tier 3/4 markets. We maintain our estimates for CY25/26/27. From the near-term perspective, order inflow remains a key monitorable.

Q1CY25 – Muted performance

Revenue grew 2.6% YoY (-6% QoQ) to Rs31.6bn. Weakness in Industrial Automation continued, with 19% YoY de-growth during the quarter. Motion/Electrification witnessed muted growth of 8%/4.7% YoY. However, Robotics (5% of sales) witnessed strong growth of 37% YoY. EBITDA margin at 18.4%, flat YoY, though declined by 110bps QoQ due to negative operating leverage. However, gross margin improved both, on YoY and QoQ basis, by 146bps and 64bps, respectively. Other income increased 6% YoY to Rs923mn. PAT was up 3.2% YoY to Rs4.7bn.

Pick in order inflow – Key monitorable Order inflow grew 4% YoY to Rs37.9bn. This included a spillover from last quarter. While base orders grew 9% YoY, large orders de-grew 44.8% YoY. The ABB management indicated delays in finalization of large orders. Base orders are likely to see growth, as ABB continues targeting ~23 market segments with its wide portfolio of 18 divisions, diversifying across tier 2/3 cities and with demand from tier 4/5 cities as well.

Increasing share of long-cycle business to have a bearing on margin

ABB’s EBITDA margin expanded to ~18.9% in CY24 from 11% in CY22, led by strong demand, favorable pricing environment, and execution of short-cycle orders. However, due to rising exposure toward long-cycle orders (~25% as of CY24 vs 8% as of CY22), revenue growth is likely to lag backlog growth. Also, improving product availability for customers has led to moderation in execution. Both factors may limit further margin

View and valuation

We project ABB’s revenue/EBITDA/PAT CAGR at 12%/10%/10% over CY24-27E. Though ABB functions in sectors that showcase favorable tailwinds from sustained public capex, we believe recovery in private capex will be a key growth trigger. ABB’s RoE/RoCE would decline to 24%/32% by CY27E (CY24: 29%/39%), on margins normalizing. We value the stock at Rs6,100 based on 57x 1YF PER (10% discount to 5Y mean) on Mar-27E earnings.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354