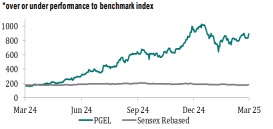

Accumulate PG Electroplast Ltd For Target Rs. 1,084 By Geojit Financial Services Ltd

Multiple growth levers in action...

PG Electroplast Ltd (PGEL), the flagship entity of PG Group is a leading electronic manufacturing service provider in India, having a diverse portfolio and panIndia presence.

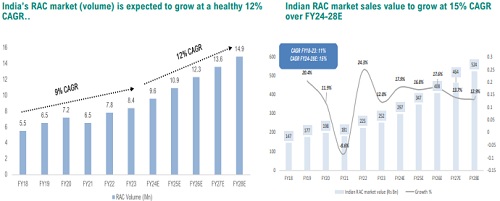

* The Indian Room Air Conditioner (RAC) industry is poised to deliver a healthy 15% CAGR over FY24-FY27E, led by rising consumption and low penetration (8%) compared to global markets (42%).

* PGEL is currently the second largest RACs player & second largest ODM (Original Design Manufacturer) for washing machine.

* A prominent player in the consumer durable industry, diversified from a plastic moulding company to an EMS player with the capability to manufacture RAC, WM, sanitaryware, and TV.

* We expect PGEL’s revenue to register 27% CAGR over FY25E-FY27E.

* The focus on backward integration and growing demand for consumer durables, we expect EBITDA margin to improve from 9.5% in FY24 to 10.3% in FY27.

* PGEL’s ROE may dip in FY25 due to the impact of QIP, we expect an improvement in asset turnover and PAT margins could enable ROE to improve to 15% by FY27E

Investment Rationale

* PGEL’s product business (RAC, WM, air cooler) contributes 68% of the total revenue (9MFY25). We expect this segment will continue to contribute a hefty part of the top-line going forward and factor a revenue CAGR of 29% over FY25E -FY27E.

* The company is planning to add more capacity in IDU, ODU, and window AC in FY26 to cater to the need for aspirational buyers and changing weather patterns in India.

* We expect the plastic and other component business to register 20% CAGR revenue over FY25E-FY27E by investing in key technologies for making importsubstitution products in India.

* PGEL, with its subsidiary PG Technoplast (PGTL), has entered into a strategic partnership with Spiro Mobility (Africa) to manufacture EVs, lithium-ion batteries, and related components.

Outlook & Valuations

The stock is currently trading above its Avg + 1SD P/E of 54x. Given PGEL’s lean balance sheet and planned foray into EV, compressor manufacturing are expected to support the current premium valuation. We are initiating coverage on PGEL with an Accumulate rating and a TP of Rs 1,084, based on a P/E of 56x on FY27E EPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345