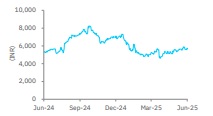

Buy Trent Ltd for Target Rs. 8,300 by Elara Capitals

.jpg)

Doubles down on India-first, own-label strategy

We attended Trent’s (TRENT IN) analyst and investor meet. Key takeaways are: a) TRENT continues to deepen its India-first strategy (to sidestep global macro volatility), with focus on own-labels, b) it is driving consumer value via high-frequency categories/brands, c) rationalizing select stores to drive better growth, d) it is nurturing scalable new brands in next five years, and e) calibrating spend with celebrity-less marketing to curtail A&P investments.

TRENT is confident as regards its legacy choices – Offline only for brand Zudio, full price selling, own-brand playbook, organic brand growth etc. – all aligned to sustain long-term growth. Technology + scale-led cost benefits and product-driven success shall help TRENT gain market share. We maintain Buy with TP unchanged at INR 8,300

Zudio – Expansion to continue offline: TRENT is keen to scale Zudio, penetrating into tier II/III cities, and densifying in existing cities such as Bengaluru and Chennai. Zudio is a culturally different brand, resonating with mass consumers. TRENT has emphasized the offline model, as online may weigh down the value perception, brand equity and interrupt inventory rotation, given price undercutting in online. Significant penetration opportunities with mass-market friendly SKUs will continue to prop brand growth. While store openings in dense clusters may partially cannibalize sales from older locations, these will help drive higher wallet share across the catchment. Expect ~16.7% store growth CAGR in FY25-28E.

Calibrated store rationalization to sustain sales quality: TRENT will continue to rationalize footprint to align with customer expectations and merchandise mix, supporting long-term growth. While TRENT signs long-term lease contracts, it has negotiated favorable terms, including walk-away options within 18-36 months, providing flexibility to reassess location viability, a paramount metric given the physical-only approach, aiding better expansion at the portfolio level. These favorable terms rule out missing the mark on rental cost and aid entering micro-markets much earlier than the competition to gain market share.

Expects new, scalable brands in next five years: Consumer preference has been dynamic, and alignment with this is key to growing in the long term. TRENT’s strategy in the next five years is to scale 1-2 pilot brands into full-fledged banners and reflect a focused approach that avoids brand sprawl, while continuing to support Westside and Zudio. However, these brand experiments may impact short-term ROC though may benefit in the long term. TRENT has emphasized on organic brand growth and building in-house talent.

Maintain Buy; TP retained at INR 8,300: TRENT has the right mindset to nurture a house of brands. Choices such as organic brand growth, customer acquisition, full price selling, foraying into high frequency categories will sustain growth. Benefits from faster inventory turns, celebrity-less A&P and common tech infra shall pare costs. TRENT aims to be operationally India-first and foray in high-frequency categories. Fast fashion brand-Zudio to remain as leader, gaining market share with strong brand recall. TRENT has high singledigital market share in the overall fashion industry, thus, the room to grow. Retain Buy with TP at INR 8,300.

Please refer disclaimer at Report

SEBI Registration number is INH000000933