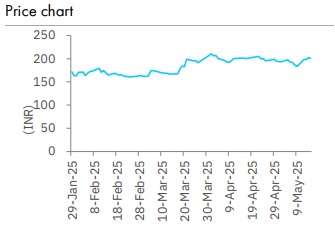

Accumulate ITC Hotels Ltd for Target Rs.225 by Elara Capitals

Occupancy and ARR both driving profitability

ITC Hotels (ITCHOTEL IN) delivered strong Q4, driven by a 14% growth in average room rates (ARR) at INR 15,000 and indicative occupancy expansion of 200bps to 79%, resulting in a 17% growth in revenue per available room (RevPAR). EBITDA margin expanded sharply to 40% (up 350bps YoY), driven by higher RevPAR premium versus the industry, ramp-up in occupancy at ITC Ratnadipa and rising management fees. ITCHOTEL has upgraded its expansion target to 220 hotels (200 earlier) with 20,000+ keys (18,000 earlier) by FY30, backed by a robust pipeline of 50 hotels (~4,500+ keys), with focus on brownfield opportunities.

ITCHOTEL enjoyed a healthy cash balance of INR 16.5bn as of FY25. Expect the hospitality business to clock in 12% topline growth, driven by 5-7% ARR growth and 100-150bps growth in occupancy. Occupancies are improving at newer hotels (five years old), many of which are still ramping up from sub-70% levels, and at ITC Ratnadipa (current occupancies <50%). Reiterate Accumulate with raised SoTP-TP of INR 225 (INR 203 earlier), ascribing 28x FY27E EV/EBITDA to the hotels business and 1x NAV to Sapphire Residences.

Plans to develop 200-key greenfield property via own portfolio: ITCHOTEL plans to develop a 200-key greenfield property at Visakhapatnam at an investment of INR 3.3bn, fully funded via internal accruals. The property is likely to commence operations in 2029. Construction is underway for a new 118-key Welcom Hotel in Puri, to be operationalized by FY28, and 100- key expansion at Welcom Hotel Bhubaneshwar.

ITC Ratnadipa – RevPAR nearly doubled between Q1 and Q4: ITC Ratnadipa in Colombo turned EBITDA positive in H2, highlighting strong operational performance. RevPAR has shown robust growth, doubling in Q4 versus Q1. With healthy occupancy and improving margins, ITC Ratnadipa is now a meaningful contributor to both revenue and EBITDA and is expected to remain a key growth driver, going forward.

Reiterate Accumulate for a raised TP of INR 225: We expect an EBITDA CAGR of ~13% for the hotel business through FY25-27E, led by scale-up in occupancy and growth in management fees income. ITCHOTEL is expected to generate healthy free cashflow every year, which can become a drag on return on capital employed (RoCE), if not employed in productive assets.

We have increased our topline and EBITDA estimates by 8% and 5% for FY26E and by 10% and 9% for FY27E. So, we raise our SoTP-based TP to INR 225 (INR 203 earlier), valuing the hotels business at 28x (unchanged) FY27E EV/EBITDA and Sapphire Residences at 1x (unchanged) NAV. We introduce FY28E financials – Retain Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933