Neutral Westlife Foodworld Ltd for the Target Rs. 675 by Motilal Oswal Financial Services Ltd

Weak print continues

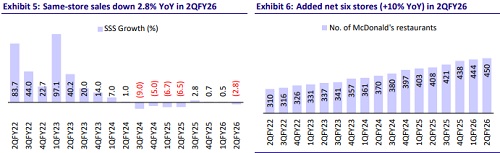

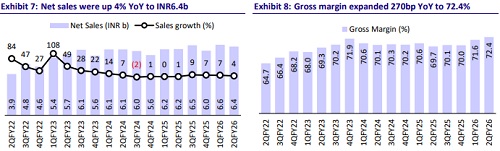

* Westlife Foodworld (WESTLIFE) reported revenue growth of 4% YoY to INR6.4b in 2QFY26. Same-store sales growth (SSSG) declined 2.8% YoY (estimate -1.5%) even on a favorable base (-6.5% in 2QFY25), with demand remaining muted in August and September. Average sales per store declined 2% YoY to INR62m (annually) in 2QFY26. On-premise sales grew 5% YoY, while off-premise sales held steady.

* The operating environment remained challenging for most part of 2Q, with industry-wide out-of-home food consumption frequency declining ~4-6% YoY. The decline in Western fast-food consumption was even more pronounced. That said, the company noted encouraging signs of recovery in October and expects eat-out frequency to gradually pick up in 2HFY26, supported by improving macros. Moreover, the company has passed on the benefit of the GST rate cut to consumers through price reductions.

* The company added net six new stores (+10% YoY) in 2Q. It plans to maintain its store expansion pace, targeting 45-50 new stores annually. It aims to grow its network to 580-630 restaurants by 2027.

* GM expanded 270bp YoY to 72.4% (est. 71%). EBITDA margin contracted 90bp YoY to 11.8%, while EBITDA margin (pre IND AS) contracted 150bp YoY to 6.2% (RBA was at 5%), primarily due to operating deleverage. ROM pre-IND AS rose 10bp YoY to 13.6%.

* WESTLIFE has faced strong demand pressure in the Southern region, leading to relatively weaker numbers than peers. We believe regional demand will see a gradual improvement and, therefore, do not expect a faster ADS recovery in 2HFY26. We reiterate our Neutral rating with a TP of INR675, based on 35x Sep’27E EV/EBITDA (pre-IND AS).

Weak performance; SSSG declines 2.8%

* SSSG declined 3%: Sales grew 4% YoY to INR6.4b (est. INR6.6b), led by store additions of 10% YoY. SSSG declined 2.8% YoY in 2QFY26 (est. -1.5%, 0.5% in 1QFY26, -6.5% in 2QFY25). WESTLIFE opened net six stores (opened eight stores, closed two stores), bringing the total count to 450 stores in 72 cities. Average sales per store declined 2% YoY to INR62m (annually) in 2QFY26.

* Broadly in-line margins: Gross margin expanded 270bp YoY and 80bp QoQ to 72.4% (est. 71%), driven by sustained supply chain efficiencies. EBITDA declined 4% YoY to INR759m (est. INR826m), primarily due to operating deleverage. EBITDA margin contracted 90bp YoY to 11.8%. (est. 12.5%), while EBITDA margin (pre-IND AS) declined 150bp YoY to 6.2% and EBITDA (pre-IND AS) declined 16% YoY. ROM pre-IND AS rose 10bp YoY to 13.6% (est. 13.3%).

* APAT witnessed a loss: APAT recorded a loss of INR180m (estimated profit of INR8m) vs INR4m profit in 2QFY25.

Key takeaways from the management commentary

* Regionally, South India, particularly Bengaluru (its second-largest city with ~65– 70 restaurants), acted as a drag on overall performance due to muted consumer sentiment and negative growth trends in the region.

* July witnessed a decent performance. However, the operating environment remained challenging through August and September. October showed MoM improvement.

* Most new stores opened in the last six months are performing ahead of expectations, with several operating above system averages.

* Strategic investments in AI-based location intelligence software are helping the company identify optimal store locations for future expansion.

* The royalty rate stands at 5% (excluding GST), with no anticipated changes in the near term.

Valuation and view

* We cut our EBITDA (pre-IND AS) estimates for FY26 and FY27 by 5-6%.

* Demand was impacted in 2Q, with SSSG declining YoY even on a low base. WESTLIFE has been aggressive in store additions, which was not the case historically. However, the current demand environment is not conducive to such rapid expansion, and performance in South India remains a challenge. Therefore, the benefits of its various initiatives may take longer to materialize than initially expected.

* The revenue gap between dine-in and delivery has narrowed, supported by improved dine-in footfalls. However, weak underlying growth, coupled with rising costs related to strategic initiatives, could weigh on the operating margin, exerting pressure on restaurant margins and EBITDA margins.

* We reiterate our Neutral rating with a TP of INR675, based on 35x Sep’27E EV/EBITDA (pre-IND AS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412