Buy ICICI Bank Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

Another quarter of operational excellence!

Margins surprise positively; asset quality remains robust

ICICI Bank (ICICIBC) continues to deliver an exemplary performance, rising above all sectoral challenges, as it sustains RoA in the range of 2.3-2.4%, which is even beyond the aspirational level for most banks.

* Moreover, the bank has maintained a strong balance sheet as provisions declined 26% YoY/50% QoQ, placing the bank well on track to comfortably beat its credit cost guidance.

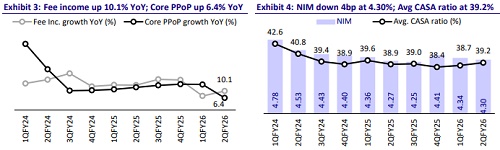

* Notwithstanding the scale of the franchise, the pace at which the bank has reduced its deposit cost over the past two quarters (down 36bp in 1HFY26) demonstrates remarkable agility and leadership execution. This has enabled the bank to deliver 3bp QoQ expansion in adjusted NIMs vs. our consensus expectation of a decline. The bank remains focused on delivering superior risk-adjusted returns, supported by prudent underwriting practices and strong credit discipline.

* 2Q PAT grew 5.2% YoY to INR123.6b (4% beat), aided by lower provisions, strong margins and controlled opex.

* NII was up 7% YoY/flat QoQ at INR215.3b (in line). NIMs declined by only 4bp QoQ to 4.3% (adjusted NIMs improved 3bp QoQ).

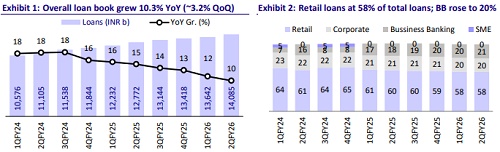

* Advances grew 10.3% YoY/3.2% QoQ, led by healthy growth in Business Banking (BB) segment and a recovery in Retail segment. Deposits were flat QoQ (up 7.7% YoY), while CASA mix stood at 40.9%.

* Fresh slippages declined to INR50.3b (INR62.5b in 1QFY26). GNPA ratio declined to 1.58%, while NNPA ratio declined to 0.39%.

* We maintain our earnings estimates and expect FY27E RoA/RoE of 2.3%/17.0%. ICICIBC remains our preferred BUY in the sector with a revised TP of INR1,700 (2.8x FY27E ABV).

CD ratio inches up to 87%; slippage ratio under control

* 2Q PAT grew 5.2% YoY/fell 3.2% QoQ to INR123.6b (4% beat), aided by lower provisions, strong NIMs and contained opex.

* NII was up 7.4% YoY/flat QoQ at INR215.3b (in line). NIMs declined marginally by 4bp QoQ (adj. NIMs improved 3bp QoQ), while management expects range-bound NIMs for the next two quarters.

* Other income declined by 11% QoQ to INR75.8b (4% miss) due to lower treasury gains in 2Q, while fee income was healthy.

* Opex rose 12.4% YoY/3.6% QoQ to INR118b (in line). C/I ratio thus increased to 40.6% (up 276bp QoQ). PPoP declined by 8% QoQ to INR172.9b (in line).

* On the business front, advances grew by 10.3% YoY/3.2% QoQ, led by faster growth in the BB segment at 24.8% YoY/6.5% QoQ (21% of the book), while retail grew by 2.4% QoQ (58% of the book).

* Deposits stood flat QoQ (up 7.7% YoY). CASA ratio declined 35bp QoQ to 40.9%; however, average CASA mix improved 50bp QoQ to 39.2%.

* Fresh slippages came in at INR50.3b (INR62.5b in 1QFY26). GNPA ratio declined by 9bp QoQ to 1.58%, while NNPA ratio declined by 2bp QoQ to 0.39%. PCR declined by 29bp QoQ to 75.6%, while the contingency buffer was unchanged at INR131b (0.9% of loans).

Highlights from the management commentary

* NIMs are expected to be range-bound and the bank does not expect much movement in the coming quarters.

* LDR has expanded by over 400bp in the past two quarters. LDR can even go further given that the CRR cut is going to release liquidity.

* Retail asset quality was not bad at any point in time. Secured retail had been stable. There was some spike in PL and cards. The benefit of portfolio actions has started to show up and the bank is looking at growth recovery in these segments.

Valuation and view

ICICIBC reported another commendable quarter, wherein the bank saw healthy NIMs, lower provisions, controlled slippages and contained opex. Its focus on the betteryielding assets has helped the bank to have fair control over NIM compression, with next quarter expected to have the benefit of CRR cuts and cost of fund repricing. The bank’s investment in technology has resulted in consistent productivity gains, along with market share gains and steady improvement in cost ratios. Asset quality remains under control, while ECL impact is expected to be fairly manageable for the bank. The bank continues to carry a contingency provisioning buffer of INR131b (0.9% of loans). We maintain our earnings estimates and expect FY27E RoA/RoE of 2.3%/17.0%. ICICIBC remains our preferred BUY in the sector with a revised TP of INR1,700 (2.8x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412