Buy Avenue Supermarts Ltd for the Target Rs. 5,000 by Motilal Oswal Financial Services Ltd

Largely in-line results; pressure on gross margin eases

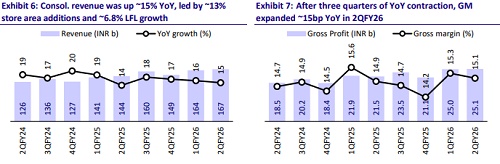

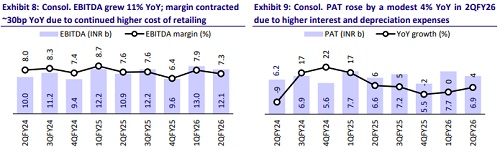

* Avenue Supermarts (DMART) posted in-line results in 2QFY26 standalone EBITDA grew 11% YoY as margin contracted 30 bp YoY to 7.6% (in line).

* After three quarters of contraction, DMART’s gross margin (GM) expanded 5bp YoY to 14.2% (~20bp beat) in 2QFY26. However, cost of retailing (CoR) remained elevated, with ~7% YoY uptick on a per sqft basis (+35bp YoY).

* DMART’s 2Q standalone revenue grew ~15% YoY, driven by ~13% store area addition and 6.8% like-for-like (LFL) growth (on a low base of 5.5% YoY).

* DMART added eight stores in 2QFY26 (17 in 1H vs 12 YoY). Acceleration in store additions remains the primary growth driver for the company. We continue to build in 60 store additions in FY26 and note a YoY increase of ~9%/38% in cash capex and CWIP, respectively, during 1HFY26.

* With quick commerce (QC) players potentially shifting their focus to profitable growth, we believe the peak of competitive intensity may be behind us. However, increased pricing competition from the entry of large online/offline retailers into QC remains a key monitorable.

* We raise our FY26 EBITDA by ~2%, led by a higher GM, while keeping FY27-28 estimates broadly unchanged. Our FY26-28E PAT is also broadly unchanged.

* We build in a CAGR of 18%/18%/16% in DMART’s consol. revenue/EBITDA/PAT over FY25-28E, driven by 15% CAGR in store additions and ~7% LTL growth.

* We assign a ~46x Dec’27 EV/EBITDA multiple (implying ~80x Dec’27 P/E) to arrive at our revised TP of INR5,000. We reiterate our BUY on DMART.

In-line 11% YoY standalone EBITDA growth; rising interest/D&A costs hurt PAT (5% YoY)

* Standalone revenue rose ~15% YoY to INR162b (in-line), driven by ~13% area additions and 6.8% LFL growth (vs. 7.1% in 1Q and 5.5% YoY).

* The company added eight stores/0.3m sqft area to reach 432 stores and 17.9m sqft. This implies addition of an average 37.5k sqft stores in 2QFY26 (which is relatively lower than average store size of 41.5k sqft).

* DMART’s store count rose ~15% YoY, while the annualized revenue per store rose ~1% YoY to INR1.5b and annualized revenue/sq. ft grew ~1.5% YoY to INR36.6k.

* Standalone gross profit stood at INR23.1b (up ~16% YoY, 2% above estimates) as GM expanded ~5bp YoY to 14.2% (~20bp beat).

* The share of the higher-margin GM&A category remained stable YoY, while the share of the Foods category increased ~40bp YoY, at the expense of Non-food FMCG.

* Standalone EBITDA at INR12.3b (in line), rose ~11% YoY, as margins contracted 30bp YoY to 7.6% (in line) due to a 7% YoY increase in the CoR per sq. ft. (~35bp YoY, 20bp above estimates).

* Employee costs surged 33% YoY, while other expenses grew 17% YoY, as DMART continues to spend on improving service levels amid cost inflation in entry-level jobs.

* Standalone PAT at INR7.5b (in line) rose by modest ~5% YoY, with PAT margin moderating 45bp YoY to 4.6% due to higher depreciation (+23% YoY), interest cost (2.4x YoY), and tax rate.

OCF up 41% YoY, but FCF outflow continued due to rising capex

* DMART’s 1HFY26 standalone revenue/EBITDA/PAT grew 16%/9%/4% YoY.

* Based on our estimates, the implied revenue/EBITDA/PAT growth for 2HFY25 is 18%/17%/13%.

* DMART’s 1HFY26 OCF (after interest and leases) rose 41% YoY to INR12.7b, driven by 9% YoY EBITDA growth and favorable WC movement.

* With a 9% YoY increase in cash capex, DMART’s 1HFY26 FCF outflow stood at INR4.3b (vs. INR6.6b outflow in 1HFY25).

* DMART’s net debt, excluding leases, stood at INR835m (vs. INR2.6b/INR3.3b net cash as of Sep’24/Mar’25).

Foods share grew 40bp YoY at the expense of FMCG; GM&A stable YoY

* General merchandise and apparel (GM&A): 2Q growth stood at ~15.1% YoY (vs. ~15.4% YoY in 1QFY26) with share in DMART’s category mix stable YoY at 22% (down ~10bp YoY to 23.3% in 1HFY26)

* Food: Foods, the largest contributor to DMART’s revenue, saw a moderation in growth to ~16% YoY in 2Q (vs. ~18% YoY in 1QFY26). However, the category’s contribution to DMART’s mix increased 40bp YoY to 58.4% in 2QFY26 (up 60bp YoY to 57% in 1HFY26)

* Non-food FMCG: The non-food FMCG continued to remain the weakest segment, with ~13.3% YoY growth (vs. ~12.6% YoY in 1QFY26) as its share in DMART’s mix declined ~40bp YoY to 19.6% in 2QFY26 (down 50bp YoY to 19.7% in 1HFY26).

Consolidated EBITDA rises 11% YoY as margins contract ~30bp YoY

* Consolidated revenue grew 15.5% YoY to INR167b (in line).

* Consol. GP grew 17% YoY to INR25.1b (2% above), as GM expanded ~15bp YoY to 15.1% (~30bp beat).

* Consol. EBITDA rose 11% YoY to INR12.1b (in line) as margins contracted ~30bp YoY to 7.3% due to higher CoR in store operations and ~3.6% operating loss margin in subsidiaries (vs. -3.3% QoQ and -2.9% YoY).

* Consol PAT grew by modest ~4% YoY to INR6.85b (2% lower). PAT margins contracted ~45bp YoY to 4.1% (-10bp QoQ).

DMART Ready consolidates its city footprint with a focus on large metros

* Leadership transition: The CEO-designate, Mr. Anshul Asawa, took charge of all operational aspects of DMART’s B&M stores business during the quarter.

* Bill cuts and ABV: Total bill cuts for 2QFY26 stood at 97m, rising ~14% YoY, while the average basket value (ABV) rose 1% YoY to INR1,672.

* DMART Ready: DMART Ready added 10 new fulfilment centers in its existing markets and continued to invest and deepen its presence in large metros. However, it has ceased operations in five cities (Amritsar, Belgavi, Bhilai, Chandigarh, and Ghaziabad) and is now present in 19 cities (vs. 25 at FY25-end).

* GST Passthrough: Following the government’s recent announcement on GST reforms, the company has passed on the benefit of reduced GST rates.

Valuation and view

* With QC players potentially shifting their focus to profitable growth, we believe the peak of competitive intensity may be behind us. However, increased pricing competition from the entry of large online/offline retailers in QC remains a key monitorable and could weigh on DMART’s near-term growth and margins.

* We believe DMART’s value-focused model and superior store economics will ensure its competitiveness and customer relevance over the longer term despite QC’s convenience-focused model.

* Acceleration in store addition remains the key growth trigger for DMART. We build in ~60 store additions in FY26 (vs. 17/50 store additions in 1HFY26/FY25).

* We raise our FY26E EBITDA by ~2%, driven by higher GM, while keeping FY27-28 estimates broadly unchanged. Our FY26-28E PAT is broadly unchanged.

* We build in a CAGR of 18%/18%/16% in DMART’s consol. revenue/EBITDA/PAT over FY25-28E, driven by a 15% CAGR in store additions and ~7% LTL growth.

* We roll forward our valuation base to Dec’27 (vs. Sep’27 earlier) and assign ~46x EV/EBITDA multiple (implying ~80x Dec’27 P/E) to arrive at our revised TP of INR5,000 (earlier INR4,800). We reiterate our BUY rating on DMART.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412