Cross-Country Comparison of Banking Sector in The Leading Global Economies by CareEdge Ratings

Synopsis

* India, where banking margins remain relatively high despite a low bank credit-to-GDP ratio, indicating substantial headroom for credit expansion. In contrast, developed economies exhibit significantly higher credit penetration but operate with compressed margins, reflecting mature and competitive banking systems. This structural advantage strengthens India’s attractiveness as a growth market. It supports the case for foreign banks to expand operations and establish regional centres to capture long-term credit growth opportunities.

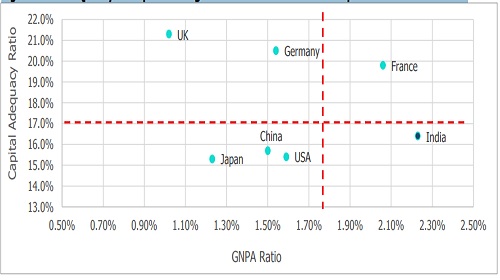

* Despite historically higher Gross Non-Performing Assets (GNPA) levels, Indian banks now operate with GNPA and Net Non-Performing Assets (NNPA) ratios at multi-year lows, reflecting a substantial clean-up of legacy stress. This improvement, combined with adequate capital buffers, positions the banking system favourably to absorb incremental credit risk while continuing to support sustained loan growth.

* With our assessment of risk-adjusted profitability, India’s positioning in the high-return, low-leverage quadrant indicates superior risk-adjusted profitability. Unlike several developed peers that rely on higher leverage to generate returns, Indian banks achieve stronger ROE with moderate gearing, underscoring efficient capital utilisation and structural growth potential.

* China’s banking system is approximately 15–17x larger than India’s in balance-sheet terms, underscoring significantly deeper financial intermediation and higher credit intensity. The U.S. banking sector remains 6–7 times larger. Meanwhile, Germany’s banking system is only 2–3x larger than India’s but operates with materially higher leverage and credit penetration.

India’s Banks Show Improving Strength in a Global Setting0F0F 1

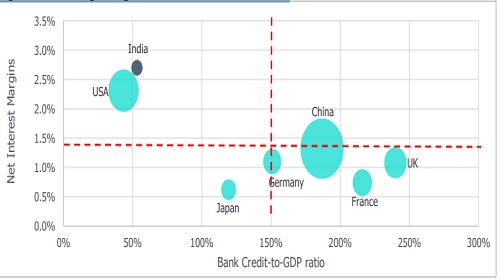

Figure 1: India: High Margins Amid Low Credit Penetration

* The above figure highlights a clear divergence between banking systems with high credit penetration and those with stronger profitability. Advanced economies such as the UK, China, and France exhibit elevated Credit-toGDP ratios but operate with compressed net interest margins (NIMs), reflecting intense competition. In contrast, India stands out with relatively low credit penetration alongside the highest margins, underscoring a structurally favourable opportunity for profitable banking expansion. This positioning suggests significant headroom for growth in India without the leverage-driven risks evident in more mature banking systems. This structural advantage strengthens India’s attractiveness as a growth market. It supports the case for foreign banks to expand operations and establish regional centres to capture long-term credit growth opportunities.

Figure 2: Asset Quality vs Capital Strength: India’s Transition from Repair to Growth Readines

Above views are of the author and not of the website kindly read disclaimer