Buy Lodha Developers Ltd for the Target Rs. 1,888 by Motilal Oswal Financial Services Ltd

Strong financials and steady presales fuel 2Q performance

Achieves 100% of guided FY26 BD in the first half itself

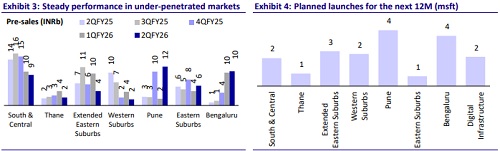

* In 2QFY26, Lodha Developers (LODHA)’s presales rose 7%/3% YoY/QoQ to INR45.7b (in line). In 1HFY26, its presales grew 8% YoY to INR90.2b.

* With the Supreme Court of India approving the Environmental Clearance (EC) process in late August for certain projects, the company is set for significant project launches in the second half of the year.

* LODHA’s collections grew 13%/21% YoY/QoQ to INR34.8b (13% below our estimates) and are expected to strengthen in 2HFY26. In 1HFY26, collections rose 10% YoY to INR63.6b.

* LODHA added one new project in MMR with a GDV of INR23b in 2QFY26. With this, it was able to achieve its full-year BD guidance of INR250b in 1HFY26 itself (six new projects added in MMR, Pune, and Bengaluru).

* Net debt increased ~INR2.7b to INR53.7b in 2QFY26, albeit below the ceiling of 0.5x net debt/equity.

* LODHA reported revenue of INR38b, +45%/+9% YoY/QoQ (17% above estimates). In 1HFY26, it reported INR73b in revenue, rising 33% YoY.

* EBITDA (excl. other income) rose 57% YoY/13% QoQ to INR11.1b (19% above our estimates). Reported EBITDA margin stood at 29%. According to management, the embedded EBITDA margin for presales stood at ~32% in 2Q. Adjusted EBITDA (excluding interest charge-off and capitalized interest) stood at INR13.1b, with a margin of 34.5%. In 1HFY26, EBITDA stood at INR21b, up 43% YoY, with a margin of 29%. Embedded EBITDA margin for presales stood at ~32%. Adjusted EBITDA (excluding interest charge-off and capitalized interest) stood at INR25.1b, with a margin of 34.4%.

* Reported PAT came in at INR7.9b, rising 86% YoY and 17% QoQ (19% above estimates), while adjusted PAT came in at INR7.9b, rising 88% YoY with a 21% margin. In 1HFY26, reported and adjusted PAT rose 63% YoY each, at INR14.6b and INR14.7b, respectively, with a 20% adjusted PAT margin.

Key highlights from the management commentary

* LODHA continues to see strong housing demand, led by consumer preference for high-quality homes and expectations of lower interest rates, with an aim to raise weekly sales to INR4b by the end of FY26 (vs. INR2.5b in FY25).

* In 1HFY26, launches totaled INR133b (7.8msf), with another INR140b planned for 2HFY26, keeping new launches’ contribution to overall sales at around 30–35%.

* Of the INR120b guided sales for 2H, about 60% is expected from non-launch projects; price growth of 5–6% is anticipated in FY26, with quarterly presales averaging INR50b.

* Embedded EBITDA margins remain healthy at ~32% overall, led by 38% for own projects and 28% for JDAs.

* The company is expanding geographically, with Bangalore emerging as a key growth driver (targeting 15% of sales over the next decade), Pune contributing 16–18% in FY26, NCR entering the pilot phase in FY27, and township and digital infrastructure segments enhancing visibility and annuity income.

Valuation and view

* The company has delivered steady performance across its key parameters, and as it prepares to capitalize on strong growth and consolidation opportunities, we expect this consistency in operational performance to continue.

* At Palava, LODHA has a development potential of 600msf. However, we assume that a portion of this would be monetized through industrial land sales. We value 250msf of residential land to be monetized at INR637b over the next three decades.

* We use a DCF-based method for the ex-Palava residential segment and arrive at a value of ~INR549b, assuming a WACC of 11.1%. Reiterate BUY with a TP of INR1,888.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412