Buy Granules India Ltd for the Target Rs. 650 by Motilal Oswal Financial Services Ltd

FD remains on a robust footing Gearing up for

USFDA inspection at its Gagillapur site

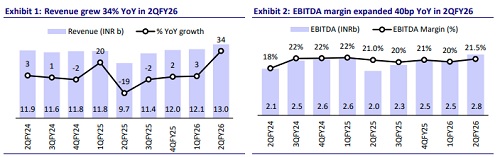

* Granules India (GRAN) delivered better-than-expected operational performance (9.5%/8.3% beat on revenue/EBITDA). However, earnings were in line with estimates due to higher depreciation and tax rate for the quarter.

* GRAN showed improved performance in the Finished Dosage (FD), Intermediates (PFI), and API segments for the quarter. The addition of CDMO revenue further boosted YoY growth.

* With strong traction in FD and the addition of the CDMO business, gross margin continued its upward trend, reaching a five-year quarterly high of 65.7%.

* Geography-wise, North America/EU led YoY growth in 2QFY26, with revenue from the ROW market providing additional support.

* Notably, the cash conversion cycle was further reduced to 204 days in 2QFY26.

* That said, net debt continues to rise for the second consecutive quarter.

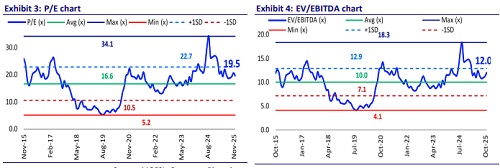

* We have trimmed our FY26 estimates by 3%, factoring in the delay in the USFDA inspection at the Gagillapur site. We have largely maintained our estimate for FY27/FY28. We value GRAN at 19x 12M forward earnings to arrive at a TP of INR650.

* We expect 16%/20%/25% revenue/EBITDA/PAT CAGR over FY25-28, on the back of 15%/12%/13% CAGR in FD/PFI/API revenue and a 150b margin expansion. With a) remediation measures largely done, b) scale-up in CDMO activities, and c) the addition of capacities, we expect GRAN’s earnings trajectory to remain on an uptrend. Reiterate BUY.

Segmental mix offset by higher opex

* GRAN’s 2QFY26 sales grew 34.2% YoY to INR12.9b (our est. of INR11.8b), driven by the formulations business in North America and Europe.

* FDF sales grew 29% YoY to INR9.6b (74% of sales).

* Intermediate (PFI) sales grew 76% YoY to INR1.3b (10% of sales).

* API sales grew 20% YoY to INR1.7b (13% of sales).

* Gross margin expanded 370bp to 65.7%, driven by a better product mix and improvement in operational efficiency.

* However, EBITDA margin expanded 40bp YoY to 21.5% (our est. of 21.7%), supported by higher employee costs/other expenses (up 40bp/280bp as a % of sales).

* EBITDA grew 36.8% YoY to INR2.8b (our est. of INR2.6b) for the quarter.

* Adjusted PAT grew 34.3% YoY to INR1.31b (our estimate: INR1.32b).

Highlights from the management commentary

* After providing adequate information about the remediation measures implemented at Gagillapur, the USFDA will be meeting with GRAN’s management in Jan’26.

* USFDA has issued the EIR for the Chantilly, US site following the inspection for the first-to-file controlled substance product.

* The successful USFDA inspection at the greenfield formulation facility in Genome Valley has increased capacity by 40%, enabling higher supply to the US market.

* EBITDA improved on operational efficiencies and a better mix but was partly offset by an INR200m loss from the peptides business.

* GRAN has expanded capacity, diversified its portfolio, and strengthened compliance to support growth going forward.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412