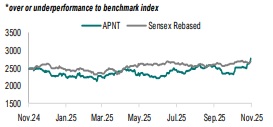

Buy Asian Paints Ltd For Target Rs. 3,244 By Geojit Financial Services Ltd

Stellar Performance in Q2FY26...

Asian Paints Ltd. (APNT), is engaged in the business of manufacturing, selling and distribution of paints and related products for home décor. APNT is the market leader in the Indian paint manufacturing industry.

* In Q2FY26, APNT delivered strong volume growth of 10.9%, driven by early festive demand, increased brand spending, product regionalization effort, and an expanding B2B network.

* Despite aggressive marketing spend, EBITDA margin improved by 242 bps YoY, supported by deflation in RM price (~1.6%), backward integration and better product mix.

* The management maintained its EBITDA margin guidance of 18-20% for FY26 in expectation of mid single digit volume growth and revival in demand.

* Although industry competition remains high, the company’s strong brand position, combined with a healthier demand environment supported by a robust marriage season and a favourable monsoon, continues to drive volume growth.

* The company’s key backward integration projects, such as the white cement plant in Dubai, are commissioned, while the VAM/VAE project is to be commissioned in Q1FY27 to support margins.

Outlook & Valuation

With the company’s ongoing B2B expansion and product regionalisation efforts, we expect volume growth to improve to mid-single digits in FY26. A better product mix and soft input costs should further support earnings. We therefore revise our rating to BUY from HOLD with a revised target price of Rs. 3,244, based on a 55x P/E on FY28 EPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345