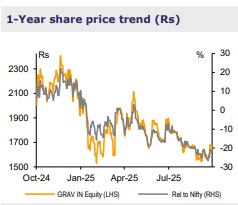

Buy Gravita India Ltd For Target Rs. 2,300 By Emkay Global Financial Services Ltd

GRAV’s Q2 serves less as an earnings event and more as a signaling point in its capital allocation trajectory. The decision to advance lead capacity ahead of diversification projects reflects a disciplined pursuit of return density, prioritizing the business line with the highest margin durability and supplychain control. Equally notable is the recalibrated capex envelope—Rs12.3bn versus Rs15bn previously—to be executed without diluting the FY28 volume ambition of 700kt (vs 334kt in FY25). This is not merely cost rationalization; it is an optimization of capital productivity, implying higher incremental ROIC. With 125kt of phased commissioning through Nov-25 to Jan-26 and proactive scrap accumulation already in motion, the company appears to be pre-solving for scale friction. The strategic question shifts from “if growth materializes” to “how efficiently it compounds from here”. We reiterate BUY and TP of Rs2,300.

Modest Q2 EBITDA beat

GRAV delivered another quarter of steady growth with a modest beat, reporting EBITDA of Rs1.1bn (up 4.8% vs Emkay; up 4.4% vs Consensus; up 10.2% YoY). Notably, the business achieved Lead EBITDA/kg of Rs23.2, which is ahead of the guidance range of Rs19-20. Consol EBITDA margin at 10.8% is on a revenue base of Rs10.3bn, which is in line with market expectations. Other income included hedging gains of Rs98mn, which are essentially part of the core business. Inventories have increased as the company started scrap stockpiling to prepare for upcoming capacity expansion.

Key takeaways from conference call

1) Operational: Domestic scrap sourcing rose to 52% from 36%, with volumes subdued by OEM inventory adjustments, while selective overseas scrap processing in India boosted margins. 2) Projects: The Mundra Lead facility will add 30kt in Nov-25 and another 50kt in Jan-26 with 45kt in Jaipur in Dec-25, supported by rapid ramp-up capability. 3) Capex: Capex through FY28 is revised lower to Rs12.3bn from Rs15bn due to a brownfield shift, with FY26 outlay cut to Rs2bn and focus maintained on core metals and new Li-ion and rubber recycling streams. 4) Aluminium: MCX aluminium hedging approvals are in place, and operational launch is awaited. 5) Outlook: H2 is expected to be strong, with Mundra additions and inventory readiness supporting 60-70% utilization by FY27, while the mgmt maintains CAGR target of >25% in volume and 35% in profit.

Lower capex intensity expansion shift to enhance return ratios

The company’s planned 125kt lead capacity expansion in FY26 and, consequently, by >100ktpa in out-years is expected to drive meaningful earnings uplift, supported by a shift toward a realigned capex strategy focused on lower-capex-intensity brownfield projects. Notably, the company is front-loading lead capacity expansion, which is margins-accretive and should enhance ROIC to 24% (21% earlier) as volumes ramp up. Consequently, we revise up FY27-28E EBITDA by 5-6%; retain TP of Rs2,300; BUY.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)

Tag News

Precious metal price fluctuations could test fast-growing gold token market