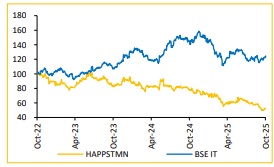

Daily Morning Briefing : Buy Happiest Minds Technologies Ltd for the Target Rs. 670 by Choice Institutional Equities

Growth Fueled by Strategic Transformation; Margins to Moderate

HAPPSTMN continued its transformational makeover, resulting in 30 new client additions in H1FY26. The new clients represent incremental revenue potential of about USD 50–60Mn over the next 3–4 years. Thus, taking cognizance of the sales potential within Gen AI Business unit (GBS) and strong Net New (NN) pipeline, the company has extended its earlier commitment of double-digit growth from 3 consecutive years to 4 years now. However, the company will invest in its strategic transformational initiatives in the near term, which we believe would keep the EBITDA margin at the lower end of its guided range of 20–22% (including other income). Hence, we have revised down our margin estimates and expect Revenue/EBIT/PAT to grow at a CAGR of 14.3%/21.8%/25.9%, respectively, for FY25–FY28E. Thus, we maintain our BUY rating with a revised target price of INR670 (earlier INR730), maintaining PE multiple of 30x, based on the FY27E and FY28E average EPS of INR 22.3.

Revenue Growth and Steady Margin amid Strategic Investments

* Reported Revenue for Q2FY26 stood at USD 65.1Mn up 1.2% QoQ (vs CIE est. at USD 65.0Mn). The CC growth was also up 2.3% QoQ. In INR terms, revenue stood at INR 5,735Mn, up 4.3% QoQ and 10.0% YoY.

* EBIT for Q2FY26 came in at INR 764Mn, up 6.7% QoQ (vs CIE est. at INR 683Mn). EBIT Margin was up 30 bps QoQ to 13.3% (vs CIE est. at 12.1%).

* PAT for Q2FY26 came in at INR 540Mn, down by 5.4% QoQ led by lower investment income. (vs CIE est. at INR 558Mn).

FY26E double-digit Growth Guidance Intact on Gen AI & Net New Wins

HAPPSTMN has witnessed 21st consecutive quarter of QoQ growth in Q2FY26 since its IPO. Management remains confident on double-digit CC growth in FY26E supported by deal closures deferred from earlier quarters, especially in BFSI. Vertical-wise, BFSI saw a modest growth of 0.7% QoQ while Edtech declined by 0.8% in Retail, Healthcare and Hi-tech saw strong growth QoQ at 12.3%, 9.7% and 9.2%, respectively in INR terms. Active clients rose by 13 QoQ to 290, reflecting improved conversions. Among business units, PDES and GenAI (GBS) grew 5.1% and 17.7% QoQ, respectively, while IMS declined 1.5% in INR terms. The newly-created Gen AI Business unit remains the key growth engine, posting 77.8% YoY growth in Q2 and 79.0% in H1FY26. We expect strong momentum to sustain, driven by Gen AI acceleration, IP-led revenue expansion and continued traction in net new client additions

FY26E EBITDAM Guidance Maintained in 20–22% Band

HAPPSTMN delivered steady operational performance in Q2FY26, with EBITDAM expanding 20 bps QoQ to 17.2% and EBITM improving 30 bps to 13.3%, despite wage hike and continued Gen AI investments. Utilisation improved by 180 bps QoQ to 80.7% along with fixed price project mix improving by 170 bps QoQ to 24.8% helping margin. Employee headcount stood at 6,554 as of Q2FY26 versus 6,523 in Q1FY26, with Attrition rate declining 80 bps QoQ to 17.4%. HAPPSTMN has reiterated 20–22% EBITDAM target despite the negative impact of wage hike and investments. This will be led by operational efficiencies from ongoing transformational initiatives, such as GenAI operations, which just broke even and improved utilisation levels

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131