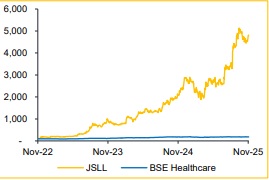

Buy Jeena Sikho Ltd For Target Rs. 950 By Choice Broking Ltd

Accelerating Growth Trajectory

Future Growth Catalyst : Capacity Expansion and OTC Foray

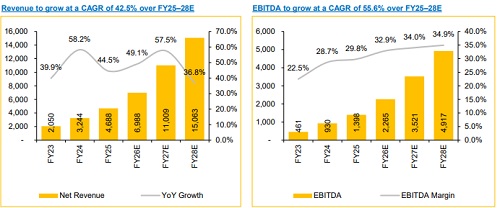

Jeena Sikho’s initiatives are aimed at enhancing asset utilisation, expanding capacity through new centre launches and bed additions. It is tapping into the high-potential OTC segment with 15–20 product launches over the next year (10 by the end of FY26) and planning overseas expansion. Therefore, we believe, JSLL is well-positioned for robust growth.

We expect JSLL to deliver significant Revenue/EBITDA/PAT CAGR of 47.6%/55.6%/65.0% over FY25–28E. We maintain our thesis on JSLL with a BUY recommendation and change our target price to INR 950 (from INR 900), by valuing the company on DCF.

Sustained growth momentum with robust margin expansion

* Revenue grew 66.4% YoY / 8.9% QoQ to INR 1,898 Mn (vs. CIE estimate: INR 1,920 Mn)

* EBITDA grew 128.5% YoY / 16.9% QoQ to INR 920 Mn (vs. CIE estimate: INR 872 Mn); margin expanded 1,318 bps YoY / 329 bps QoQ to 48.5% (vs. CIE estimate: 45.4%)

* PAT increased 120.9% YoY / 14.6% QoQ to INR 588 Mn (vs. CIE estimate: INR 580 Mn)

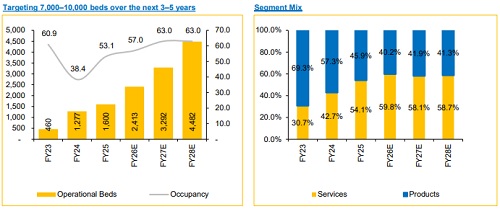

Strategic capacity expansion driving long-term scalability

With over 2,220 operational beds and 400 more under development across five facilities, JSLL is entering a new growth phase. Capacity expansion, coupled with improved utilization' rates, enhances operating efficiency and supports patient base growth. We project that JSLL will scale its bed capacity to 7,000–10,000 in the next 3-5 years and aiming to achieve an occupancy rate of ~80% (from the current 57%).

One operational ayurveda college is running at 90% occupancy and two are in the pipeline. The delay in expanding ayurveda colleges is primarily due to the pending inclusion of ayurveda under AYUSH. Once this inclusion is formalised, JSLL plans to accelerate its ayurveda college expansion initiatives. Targeting rollout of 50 new hospitals under a franchisee model to drive asset-light growth.

OTC growth & new launches to boost margins and diversify revenues

At present, there are ~10 new products in the pipeline; we expect them to get launched by end of FY26, with the first launch (Pet Shuddhi Kit) priced at INR 960 (vs. competitors at INR 115--200), charging more than 5x compared to the competitors and making ~90% gross margin. This segment offers scalable, assetlight revenue streams and strengthens the company’s blended growth model, positioning JSLL for higher margins and diversified earnings visibility.

OTC business showing strong growth momentum with repeat orders and PAT margin expected at 18–20%. Online marketing and OTC initiatives expected to add INR 3000–5000 Mn turnover over the next few years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)