Reduce Dr Reddy`s Laboratories Ltd for the Target Rs. 1,270 by Prabhudas Lilladher Ltd

Lack visibility to compensate gRevlimid erosion

Quick Pointers:

* Awaiting feedback from Health Canada for Sema in next few weeks; confident of selling 12mn pen across markets in CY26

* Lower gRevlimid sales QoQ led to decline in US sales.

Dr. Reddy’s (DRRD) Q2FY26 EBITDA was largely in line with our estimates. The base business margins and US sales ex of gRevlimid continued to remain weak. We have scale up base business margins from the current level of 15-16% to ~21% in FY27E. Our FY27 and FY28E EPS broadly remain unchanged. DRRD have been investing cash flow from gRevlimid to build pipeline across peptides, biosimilars and GLP products; benefits of that may take some time. Further thin US pipeline in near term and competition in certain key products remains a key risk. At CMP, DRRD is trading at valuations of 24x P/E on FY27E and factors in recovery in base business margins. We maintain our ‘Reduce’ rating with TP of Rs1,270/share; valuing at 24x FY27E EPS. Any big ticket ANDA approvals and sharp scale up in Semaglutide opportunity are key risks to our call.

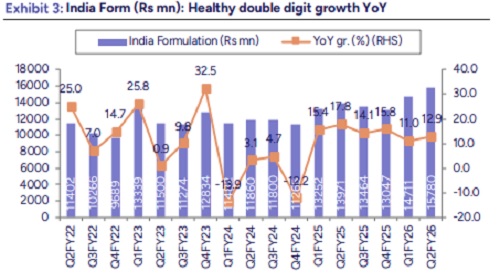

* NRT consolidation continues to aid growth momentum: DRRD’s sales grew by 10% YoY at Rs 88bn vs our estimates of Rs 85bn. The beat was aided by higher Russia, India and API Sales. Further YoY growth was aided by consolidation of NRT business which registered Rs 7bn of revenues. Adj for NRT portfolio, revenues were flat YoY. US revenue came in at $372mn ($399mn in Q1FY26); in line with our estimate. Price erosion in gRevlimid led to such QoQ decline. Domestic business grew strongly by 13% YoY to Rs 15.8bn. PSAI sales grew by 12% YoY, above our estimates. Russia sales increased by 27% YoY to Rs 8.8bn aided by higher volumes from existing business and favorable forex. EU sales included revenues from acquired NRT portfolio. Adj for this growth was 17% YoY.

* In-line EBITDA; GMs decline YoY: DRRD reported EBIDTA of Rs 20.5bn, in line with our estimates. OPM at 23.3%, down 190bps QoQ. GMs came in at 54.7%; down 220bps QoQ. The YoY was down due to pricing pressure in gRevlimid and lower PSAI margins. Segment wise PSAI margins came in at 18% (13% in Q1FY26) whereas generic margins were at 59% (60.9% in Q1FY26). Other expenses included Rs 700mn of one-off expense related to VAT liability. Adj for these other expenses were up 9% YoY. R&D expenses remained flat YoY at Rs 6.2bn (7% of revenues). Amortization expenses came in at Rs 1.96bn given NRT business consolidation while other income stood higher which included Rs 1.6bn of forex gain. Resultant PAT stood at Rs 14bn; down 4% YoY

* Key concall takeaways: US business: Revenue declined QoQ due to price erosion in key products, mainly gRevlimid. 7 products launched in the quarter; expects continued launch momentum in H2FY26. gRevlimid contribution to taper off by Q4FY26. Management sees base business stabilizing and no major incremental price erosion ahead.

* Semaglutide: Awaiting Health Canada approval; market to remain competitive given number of players. Confident on 12mn pen capacity for CY26, rising to 15–20mn by CY27 with FTO-11 cartridge line qualification. API by DRRD; pens by partner. India launch post patent expiry (Mar’26); litigation ongoing in Delhi High Court. DRRD permitted to export product till then.

* Biosimilars: gAbatacept Phase 3 completion imminent; BLA filing by Dec’25. Launch expected early CY27 (IV) and CY28 (subcutaneous). US launch to be supported by Bachupally unit however management will be doing tech transfer to CMO to mitigate regulatory risks.

* Denosumab received positive EMA opinion; Rituximab approved in EU, under review in US (CRL received). Expanded collaboration with Alvotech for pembrolizumab biosimilar. Pipeline includes nivolumab and additional oncology assets.

* EU: Growth driven by NRT acquisition and new launches. Ex-NRT, business grew 17% YoY. Completed 2/3rd integration of NRT portfolio, next phase includes Southern Europe, Israel, and Taiwan.

* India: Growth driven by new launches, pricing, and volume gains. Added 11 new brands, including Tegoprazan (PCAB) and Linaclotide (Colozo); Stugeron portfolio integration underway. Now ranked 9th in IPM; MR strength ~10,000.

* PSAI: Expect GM to move toward 20–25% range over next 1–2 years. Filed 37 DMFs in Q2. Peptide capacity of ~800 kg being built; currently small contribution but expected to scale.

* EM’s and Russia: Russia up 13% YoY (CC), aided by forex and volume growth. 24 launches across EMs during the quarter; double-digit growth momentum expected to continue.

* Others: R&D intensity with focus on peptides, complex generics, biosimilars. Maintain medium-term EBITDA margin target of 25%. SG&A to remain in 28– 30% band of revenue. Ongoing efforts to drive cost efficiency and sustain double-digit ex-US growth.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271