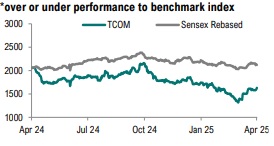

Buy Tata Communications Ltd For Target Rs. 1,927 By Geojit Financial Services Ltd

Digital transformation drives expansion

Tata Communications operates in 190+ countries, serving 7,000+ clients, including 300+ Fortune 500 companies. It is a major global network services provider, offering software-defined networking solutions.

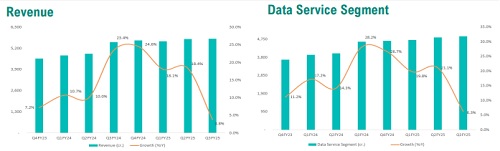

* In Q3FY25, Tata Communication Ltd revenue increased 3.8% YoY to Rs. 5,798cr, driven higher data-segment revenue.

* Data segment revenue grew 6.2% YoY to Rs. 4,903cr, aided by growth in core connectivity by 2.8% YoY to Rs. 2,590cr and digital portfolio by 10.2% YoY to Rs 2,313cr.

* Collaboration and Managed CPaaS rose 11.7% YoY to Rs. 1,177cr, aided by the launch of Kaleyra.Ai, which boosted enterprise customer adoption.

* Next Gen connectivity grew 9.2% to Rs. 248cr, supported by cloud adoption by customers, internet-based operations, and AI advancement.

* Cloud and Security fabric increased 12.5% YoY to Rs. 432cr, underpinned by the expansion of security portfolio.

* EBITDA increased 2.4% YoY to Rs. 1,181cr, driven by lower other expenses (-4% YoY) and employee benefits (-1.1% YoY). However, EBITDA margin declined 20bps YoY to 20.4%.

* Reported PAT expanded 424.0% YoY to Rs. 236cr, on higher topline

Outlook & Valuation

Tata Communications has overcome international cable-cut challenges, completing repairs and rebuilding customer relationships. Despite economic uncertainty, the company is optimistic about digital growth and margin expansion. It will invest in innovative products, focusing on digital portfolio growth and targeting a 23-25% EBITDA margin to drive customer satisfaction and capitalise on emerging opportunities. Therefore, we assign a Buy rating on the stock with a target price of Rs. 1,927, based on 23x FY27E adjusted EPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345