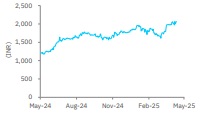

Accumulate Coromandel International Ltd For Target Rs. 2,383 By Elara Capital

Impressive volume growth

Coromandel International (CRIN IN) reported subdued Q4. EBITDA came in lower due to input cost pressures on account of a sharp increase in sulphur price. This led to lower-thanexpected increase in EBITDA per tonne for the subsidy business at INR 3,109 versus INR 5,530 estimated (all fertilizers except urea considered for calculation). Volume growth for the subsidy business at 24% was commendable and was led by a 23% increase in NPK volumes to 0.6mn tonnes, and a 69% volume growth in the SSP business to 0.2mn tonnes. We remain structurally positive on CRIN on the back of aggressive investment plans across business segments, increasing profitability in the core fertilizer business and rising free cashflow (after meeting capex requirement). We maintain Accumulate with a higher TP of INR 2,383 (INR 2,317 earlier), based on 22x FY27E (same as earlier) EPS of INR 107.

Acquisition of NACL Industries to strengthen CRIN’s crop protection business: CRIN has acquired a 53% stake in NACL Industries (NACL) for INR 8.20bn. It has also rolled out an open offer to minority shareholders, to acquire another 26% stake at INR 76.7 per share. This acquisition enhances CRIN’s portfolio to a diverse range of technicals and a pan-India presence in branded formulations. CRIN is likely to extend working capital facility to NACL, which shall address most of the challenges for the latter.

Key capex projects on schedule: The construction of a phosphoric acid plant (0.2mn tonnes) and a sulphuric acid plant (0.6 mn tonnes) is 40-45% complete (on track for commissioning by Q4FY26). The construction of a 0.75mn tonne NPK granulation project commenced in January and should be completed in 18–20 months (commissioning targeted in H2FY27). Parallelly, debottlenecking efforts are being evaluated at both Kakinada and Vizag units to increase fertilizer production volumes. CRIN is also planning to expand active ingredient manufacturing capacity at Dahej.

Maintain Accumulate with a higher TP of INR 2,383: We have incorporated NACL’s financials into CRIN’s, but the former’s contribution to overall financials of CRIN is immaterial even post turnaround till FY27E. Post the elevation of Mr. Sankarasubramanian to the helm of affairs, growth visibility across all the business segments and sub-segments has improved significantly, driven by the management’s plan to scale up such segments. These growth plans are likely to improve profitability for all the divisions and up their contribution to the overall profit pool.

While CRIN continues on the path to achieve these growth targets, cash accumulation will also increase – Annual cash generation will outweigh deployments in expansion projects. We have reduced CRIN’s PAT estimates by 2.4% for FY26E (ex-NACL), increased FY27E EBITDA by 5% for the consolidated entity and introduced FY28E financial projections. We maintain Accumulate with a higher TP of INR 2,383 (INR 2,317 earlier), based on 22x FY27E (same as earlier) EPS of INR 107 to factor in turnaround in NACL operations.

Please refer disclaimer at Report

SEBI Registration number is INH000000933