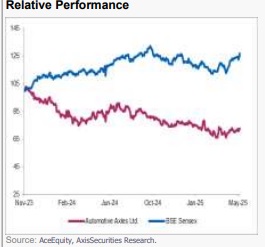

Buy Automotive Axles Ltd For Target Rs. 1,940 - Axis Securities Ltd

Est. Vs. Actual for Q4FY25: Revenue – MISS; EBITDA – INLINE ; PAT – INLINE

Change in Estimates post Q4FY25

FY26E/FY27E: Revenue: 1.2%/1.2%; EBITDA: 1.3%/3.6%; PAT: 2.1%/4.4%

Recommendation Rationale

Industry Outlook: We expect the MHCV production volumes to see low single-digit YoY growth in FY26 (~400 MHCV volumes). As per the management, gradual recovery in Europe and the US is expected to improve CV volumes CY27 onwards.

Long-term growth drivers: (1) Product diversification to new bus axles (expect axles for 13.5/15 mt buses to begin commercial production by FY26E post final trials by the end-user OEMs); (2) electric vehicle (EV) axles; (3) Increased export share post plant modernising (expect parent Meritor to play a vital role); (4) Expansion of the aftermarket business.

EBITDA/Axle: Industry registered 8.6 Mn tonnage in FY25 vs 8.7 Mn tonnage in FY18-19 (peak); however, only 10.32 Lc units were produced in FY25 vs 11.12 Lc units in the respective periods. This clearly indicates a shift to higher tonnage per vehicle, resulting in better EBITDA/axle realisation for the company by up to 25% from FY19.

Company Outlook & Guidance : Based on strategic long-term growth drivers, the company aims to double its top-line revenue and achieve a CAGR of 14-15% over FY25-29.

Current Valuation: 16x FY27 EPS (earlier 17x)

Current TP: Rs 1,940/ share (Rs 1,975/share)

Recommendation: We maintain a BUY rating with a 12% upside potential.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633