Neutral Data Patterns India Ltd for the Target Rs. 2,950 by Motilal Oswal Financial Services Ltd

Large strategic contract execution drives revenue growth Strong beat on revenue and EBITDA

* Data Patterns (DATAPATT) reported a strong quarter, with revenue surging 3.4x YoY. This growth was fueled by a high contribution from the Development segment (up 106x YoY), as the company delivered a strategic contract of ~INR1.8b (taken at a competitive price considering possible longterm opportunities). However, this resulted in a 15.4pp YoY dip in EBITDA margin. Further, the Production/Service segments grew 24%/69% YoY.

* The closing order book as of Sep’25 dipped 31% YoY to INR6.7b. However, strong order book visibility, driven by additional BrahMos orders from the Air Force and Navy and ECIL, prompted the management to target additional orders of INR10b over the next two quarters. The company has retained its FY26 revenue growth/EBITDA margin guidance of ~20-25%/35-40%.

* We broadly retain our FY26/FY27/FY28 estimates and reiterate our Neutral rating with a TP of INR2,950 (premised on 40x Sep’27E EPS).

Margins dip due to an order mix change in 2Q

* DATAPATT’s consolidated revenue jumped 3.4x YoY to INR3.1b (est. of INR1.4b) in 2QFY26. Revenue from Development/Service/Production grew 106x/69%/24% YoY to INR1.9b/INR123m/INR1.0b.

* In terms of products, Radar/Avionics accounted for the largest revenue mix at ~74.1%/12.2%. In terms of customers, DRDO played a significant role this quarter, accounting for ~64% of the mix.

* DATAPATT’s gross margin dipped 37.4pp YoY to 39%. Employee/other expenses contracted 17pp/5pp YoY to 12.3%/5.1% in 2QFY26.

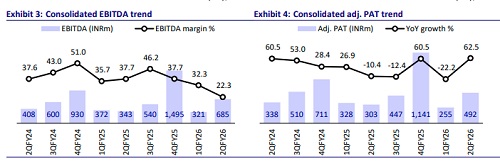

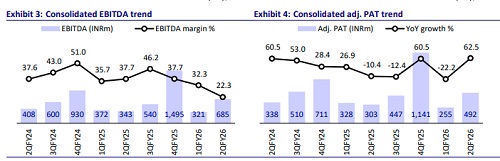

* Accordingly, EBITDA margin contracted 15.4pp YoY to 22.3% (est. ~40%). EBITDA surged 2x YoY to INR685m (est. INR544m). Adj. PAT increased 62% YoY to INR492m (est. of INR456m).

* The order book stood at ~INR6.7b as of Sep’25 vs. INR8.1b/INR9.7b in Jun’25/Sept’24. Development/Production/Service accounted for 17%/49%/ 34% of the total order book.

* In 1HFY26, the company’s revenue/EBITDA/Adj. PAT jumped 2.1x/41%/18% to INR4.1b/INR1b/INR747m. For 2HFY26, implied revenue/EBITDA/PAT growth translates into 5%/12%/16% as management guided 20-25% growth in FY26 despite strong 1H growth.

* The company had a cash outflow of INR498m vs. INR280m in Sep’24. WC days decreased by 83 days to 345, led by a dip in receivables (down 42 days) and inventory (down 58 days). While payables decreased to 26 days (down 17 days). Management expects to maintain working capital at this level for the full year.

Key highlights from the management commentary

* AMCA Jets: DATAPATT is participating in the Advanced Medium Combat Aircraft (AMCA) program as part of a consortium alongside Bharat Forge and BML, aiming to leverage its unique electronics and avionics expertise for this major Indian fighter aircraft initiative.

* Orders: The company’s order book stands at INR6.7b, with over INR3.5b in new orders received since the start of the financial year, including significant wins from ECIL and the Brahmos. Management is targeting over INR10b in additional orders over the coming quarters.

* Exports: The export order book remains healthy at around INR782m, supported by increasing traction in international markets. The company has secured a European export order and is gaining traction in South America and the UK. It is pursuing global proposals, expanding UK contracts, and partnering with foreign players for co-development of radar systems.

Valuation and view

* DATAPATT reported a strong quarter largely due to the INR1.8b strategic order received by the company (this is not expected to repeat in the coming quarters). The company’s guidance of higher-order bookings in FY26 supports its nearterm outlook.

* Further, long-term tailwinds, such as: 1) strong order book visibility, 2) differentiated product building competencies, 3) long-term relationships with clients, and 4) a strong pipeline of products, will drive sustainable growth. It remains confident of a 20-25% revenue growth over the next 2-3 years.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 28%/28%/28% over FY25-28. We reiterate our Neutral rating with a TP of INR2,950 (premised on 40x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412