Buy Lemon Tree Hotels Ltd for the Target Rs. 200 by Motilal Oswal Financial Services Ltd

Steady quarter; 2H to be robust

Operating performance misses estimates

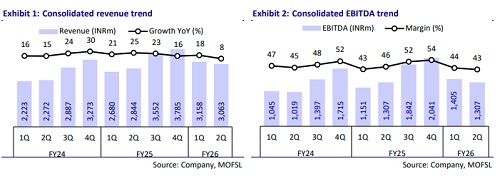

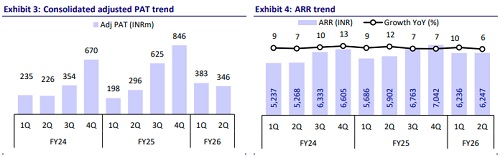

* Lemon Tree Hotels (LEMONTRE) reported decent revenue growth of 8% YoY in 2QFY26, led by average room rate (ARR) growth of 6% YoY to INR6,247. Occupancy rate (OR) improved 140bp YoY to 69.8%. However, EBITDA margins declined by 330bp YoY due to increased investments in renovation, technology and one-time ex-gratia payments to employees (8% of revenue in 2Q).

* LEMONTRE saw steady growth momentum in 2Q, despite macro headwinds such as tariff wars, floods and GST revisions. However, 2H is expected to be strong, backed by more operational rooms (less renovation in 2H), higher MICE activity (more wedding days) and healthy tourism-led demand. As a result, we expect double-digit RevPAR growth in 2H, led by high ARR growth.

* We largely maintain our FY26/FY27/FY28 EBITDA estimates and reiterate our BUY rating on the stock with our SoTP-based TP of INR200 for FY28.

Margin impacted by one-time expense and higher renovation opex

* Revenue grew 8% YoY to INR3.1b (in line). OR rose 140bp YoY to 69.8%. ARR increased 6% YoY to INR6,247. Management fees grew 7% YoY to INR143m.

* EBITDA remained flat YoY at INR1.3b (est INR1.4b). EBITDA margin contracted 330bp YoY to 42.7% (est. 44.5%). Adj. PAT increased 17% YoY to INR346m (est. in line).

* During the quarter, LEMONTRE signed 15 new management and franchise contracts, which added 1,138 new rooms to its pipeline, and operationalized five hotels, which added 272 rooms to its portfolio.

* As of 30st Sep’25, the total operational inventory comprised 121 hotels with 10,956 rooms, and the pipeline included 121 hotels with 9,118 rooms.

* In 1HFY26, revenue/EBITDA/adj. PAT grew 13%/10%/47% to INR6.2b/ INR2.7b/INR729m. In 2HFY26, our implied revenue/EBITDA/PAT growth is 14%/16%/35%.

* Gross debt stood at INR16.1b as of Sept’25 vs. INR16.9b as of Mar’25. CFO stood at INR2.3b as of Sep’25 vs. INR2.0b as of Sep’24.

Highlights from the management commentary

* Guidance: The company has indicated that it will reach 35,000-40,000 rooms (including pipeline) in the next three years. Three greenfield projects under Aurika brand (Shimla, Shillong, Delhi) under pipeline are expected to become operational from FY28 onward (Delhi will be the last one to be operational).

* Aurika MIAL: In 2Q, OR improved 21pp YoY to 71%. ARR fell 7% YoY to INR8,806 due to higher occupancy by non-negotiated rooms and airlines, which led to lower rates. For 3Q, management expects to clock 15% RevPAR growth YoY.

* Renovations: The company is in the last leg of renovation (1600 keys), which is expected to be completed in the next 15-18 months. In FY26 and FY27, renovation spending is estimated at INR1.3-1.4b each (majorly opex). Renovation expenses as a percent of sales will normalize to 1.5% from FY28.

Valuation and view

* LEMONTRE is expected to maintain a healthy growth momentum going forward, led by: 1) the improving ARR of Aurika Mumbai, 2) accelerated growth in management contracts (pipeline of ~8,362 rooms), 3) the timely completion of the portfolio’s renovation (by mid of FY27), leading to an improved OR, ARR, and EBITDA margin for the company, and 4) low renovation cost leading to better margins.

* We expect LEMONTRE to post a CAGR of 11%/13%/35% in revenue/EBITDA/adj. PAT over FY25-28, with RoCE improving to ~21% by FY28 from ~11.7% in FY25. We reiterate our BUY rating on the stock with our SoTP-based TP of INR200 for FY28.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412