Buy Senores Pharmaceuticals Ltd for the Target Rs. 960 by Choice Broking Ltd

Business Overview:

SENORES develops and markets complex generics and niche formulations across regulated and emerging markets, exporting to 40+ countries. It operates a USFDA-approved oral solids facility in Atlanta and multiple plants in Gujarat (India), along with a new API unit for backward integration. The portfolio includes 61 approved ANDAs and a growing pipeline in peptides, injectables and specialty drugs, complemented by 285 approved products in emerging markets. SENORES is also expanding its CDMO/CMO offering through strategic acquisitions, with Q1FY26 revenue showing strong double-digit growth across both, regulated and emerging markets.

With large regulated market exposure, how does SENORES remain resilient to tariff risks?

SENORES derives a significant share of its revenue from regulated markets, such as the US and EU (69% in Q1FY26), supported by its FDA-approved oral solids facility in Atlanta. Unlike peers that depend on India-based exports, SENORES’ US manufacturing footprint mitigates tariff-related risks and allows participation in high-barrier, high-margin segments, such as controlled substances and government contracts. The company is also expanding into sterile injectables at the Atlanta site, broadening its regulatedmarket offering beyond oral solids. Meanwhile, its India-based facilities continue to supply over 40 emerging markets, further diversifying revenue streams. This dual manufacturing and geographic strategy provides Senores with both, tariff resilience and structural growth visibility.

What makes SENORES’ pipeline distinct as compared to Indian generic peers?

SENORES’ pipeline stands out for its depth in both, regulated and emerging markets. In the US and EU, it has 70 ANDA approvals, 27 commercialised products, and 57 under development, with ~75% filings in complex generics (CGT) versus ~53% industry average—ensuring higher-margin opportunities and exclusivity windows. In emerging markets, it has filed 719 applications across 40+ countries, with 308 already approved and ~300 more expected in the next 15–18 months. We believe this dual engine of differentiated complex filings in regulated markets and a strong product pipeline in emerging markets gives SENORES a scalable, sustainable growth platform well ahead of peers.

Why Invest in SENORES?

SENORES is entering a high-growth phase supported by multiple levers:

* Strong revenue momentum: Management has guided for ~50% revenue growth, led by differentiated launches in highgrowth, low-competition therapies with CGT-linked exclusivity. Long-term CDMO contracts and US government supplies further add stability and reduce pricing volatility.

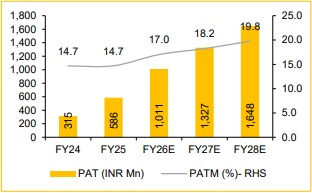

* Earnings acceleration: With injectables capex nearing completion, SENORES is set to enter its monetisation phase, driving operating leverage and supporting a sharp step-up in profitability. We model ~72% PAT growth in FY26E on a conservative basis (vs. management guidance at 100%).

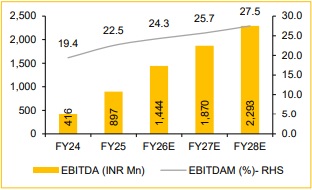

* Margin expansion: Backward integration through its new API facility, coupled with better fixed-cost absorption, is expected to drive ~175 bps EBITDA Margin expansion in FY26E.

Recommendation:

We currently have a ‘BUY’ rating on the stock with a target price of INR 960.

Key Risks:

* Limited front-end presence in emerging markets: Despite wide registrations, SENORES relies primarily on distributor-led models in most emerging geographies, which may limit pricing power or control over market share expansion.

* Execution risk in sterile injectables expansion: The US sterile injectables market is a high-barrier. Any delays in capex completion, regulatory clearances or customer onboarding could affect scale-up timelines and revenue ramp-up.

* Regulatory compliance risk: Operating across regulated and emerging markets, the company remains exposed to risks of audit observations, import alerts or approval delays that could impact product timelines and market access.

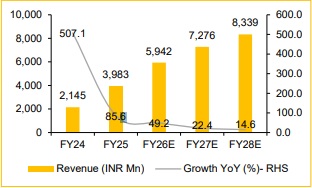

Revenue to expand at 27.9% CAGR (FY25-28E)

EBITDA set for strong growth and margin expansion

PAT to grow in-line with EBITDA

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)