Stocks in News & Key Economic Updates 24th December 2025 by GEPL Capital Ltd

Stocks in News

* GAIL: The company signed an MoU with the Government of Chhattisgarh to explore a gas-based fertilizer project and will conduct techno-economic studies for setting up a 12.7 lakh metric tonne urea manufacturing plant.

* RELIANCE COMMUNAICATION: Central Bank of India has classified the loan accounts of Reliance Telecom, an arm of Reliance Group, as fraudulent.

* LAURAS LAB: The company invested Rs.49 crore in JV KRKA Pharma to acquire 4.9 crore shares.

* GPT INFRA: The company secured a Rs.199 crore order from Northeastern Railway for construction work.

* SARDA ENERGY: The company stated that the delay in filing the accident intimation was due to late receipt of information by the Compliance Officer and an intervening holiday, and was unintentional.

* EMCURE PHARMA: The Gujarat unit received an Establishment Inspection Report (EIR) from the US FDA with a No Action Indicated status.

* BELRISE INDUSTRIES: The company signed a three-year exclusive strategic and teaming agreement with Israel-based Plasan SASA to jointly pursue defence sector opportunities, provide technical and business cooperation, and strengthen Plasan’s presence in India.

* ZYDUS LIFESCIENCES: The company’s arm entered into a pact with Bioeq AG for U.S. commercialisation rights of NUFYMCO, an interchangeable biosimilar to Lucentis, which has received US FDA approval.

* OLA ELECTRIC: The arm approved the allotment of 10 crore optionally convertible redeemable preference shares worth Rs.100 crore to Ola Cell Technologies.

* SARDA ENERGY: The company said the delay in filing the accident intimation was due to late receipt of information by the Compliance Officer and an intervening holiday, and was unintentional.

Economic News

* Mortgage companies bat for tax holiday for affordable housing projects: Under the first Pradhan Mantri Awas Yojana (PMAY), developers were eligible for a 100% income tax exemption on profits from approved affordable housing projects. The scheme ended in March 2022 and the incentive was not carried forward under PMAY 2.0, prompting mortgage lenders to seek its reintroduction.

Global News

* BOJ’s cautious tone masks hawkish resolve, raising odds of earlier-thanexpected rate hikes: The Bank of Japan’s cautious messaging has masked a clearly hawkish intent, with policymakers signaling more rate hikes sooner than markets expect. After lifting rates to a 30-year high, Governor Ueda reaffirmed further tightening as inflation appears entrenched, wages continue to rise, and real interest rates remain deeply negative. Analysts and insiders suggest the BOJ may hike every six months, with a slim chance of an earlier move as soon as April if inflation or yen weakness intensifies. A persistently weak yen, rising import costs, labor shortages, and fiscal stimulus are adding to inflationary pressure, strengthening the case for faster tightening. Markets remain uncertain about the terminal rate, but growing concern that the BOJ is “behind the curve” is keeping expectations tilted toward earlier and continued rate hikes.

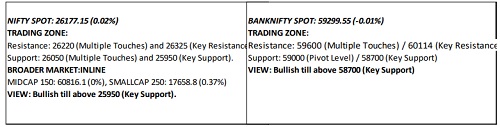

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.65% on Tuesday ended at 4.80%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.6328% On Tuesday vs 6.6678% on Monday .

Global Debt Market:

U.S. GDP data for the third quarter is set for release at 8:30 a.m. ET. Economists polled by Dow Jones expect the economy expanded by 2.8% in the third quarter. The release was rescheduled from Oct. 30 due to t he U.S. government shutdown during the fall. Durable goods figures for October are also scheduled for 8:30 a.m. ET. The bond markets will close early at 2:00 p.m. on Wednesday and will remain closed on Thursday for Christmas. During this shortened trading week, the Treasury is conducting several important debt auctions, which will offer a partial view of how investors are positioned and what their sentiments are regarding U.S. debt, inflation, and interest rate trends as 2026 approaches. A $70 billion 5-year Treasury note auction is scheduled later in the day, followed by a $44 billion 7-year auction on Wednesday

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.62% to 6.6450% level on Wednesday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer