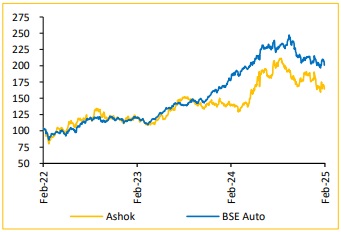

Buy Ashok Leyland Ltd For the Target Rs. 260 by Choice Broking Ltd

Strong Q3: Surpassing Expectations Across All Metrics

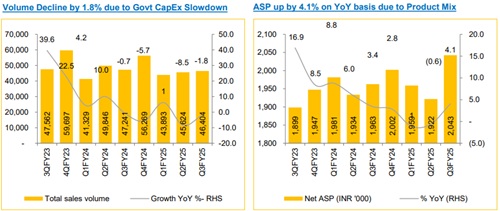

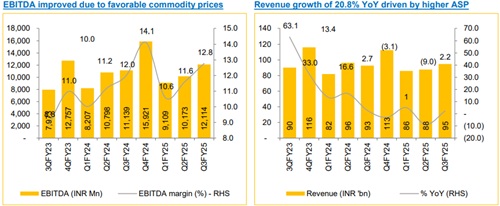

* Standalone revenue for Q3FY25 stood at INR 94,787Mn, reflecting a 2.2% YoY and 8.1% QoQ growth (vs CEBPL estimates of INR 93,820Mn). Total volumes reached 46,404 units down 1.8% YoY and up 1.7% QoQ, and a 4.1% YoY growth in ASP.

* EBITDA saw growth of 8.8% YoY and 19.1% QoQ to INR 12,114 Mn (vs CEBPL est. at INR 10,977 Mn). EBITDA margin grew 77bps YoY and 118bps QoQ to 12.8% (vs CEBPL est. at 11.7%).

* APAT for Q3FY25 grew by 31.2% YoY and 11.7% QoQ to INR 7,617 Mn (vs CEBPL est. at INR 6,798 Mn)

Expansion in High-Margin Non-CV Segments:

AL’s non-CV segment contributed 20% of total revenue, driven by spares, engines (Power Solutions), exports, and defense. The Power Solutions business saw steady momentum, with engine volumes rising 3.5% YoY and spare parts revenue increasing 14% YoY. The defense segment generated ?100 crore in Q3 FY25 revenue, with a strong order pipeline expected to drive growth over the next three to four quarters. The company’s strategic focus on these higher-margin businesses is expected to improve overall profitability and revenue stability

Strong Order Book Across Bus and LCV Segments:

Ashok Leyland has a strong order pipeline across key segments, supporting its growth outlook. The bus segment has a confirmed order for 4,000 units, scheduled for delivery over the next six to eight months. In the LCV segment, MoUs have been signed for 12,000–13,000 units with various customers.

Switch Mobility: Strategic Investments and Growth Focus:

The company has committed INR 5,000Mn to Opteier, the holding entity, to support capex for Switch India and pare down debt for Switch UK. Switch India is gaining traction with its EiV12 electric buses and LCVs, with an order book of over 1,800 buses and a monthly LCV run rate exceeding 100 units. It is expected to turn EBITDA positive in early FY26, with long-term plans for a public listing after scaling operations. Meanwhile, Switch UK faces market uncertainties, prompting cost rationalization and debt reduction initiatives

View and Valuation:

We have marginally adjusted our FY26/27 EPS estimates by +0.5%/+0.7% and rolled forward our forecasts, arriving at a revised target price of ?260 (valued at 20x FY27E EPS plus the value of HLFL), while changing our rating to ‘BUY’

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131