Buy Zee Entertainment Enterprises Ltd For Target Rs. 200 By JM Financial Services

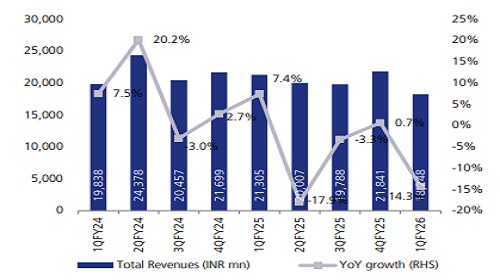

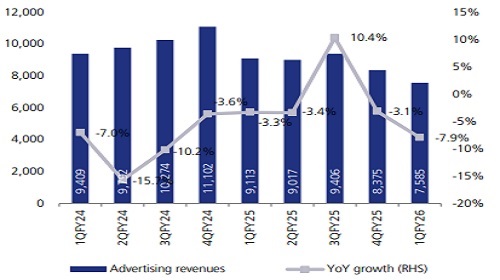

ZEEL reported a weak quarter overall. A still anaemic ad-spend environment, on-going DPO negotiations for price hikes and weak release calendar weighed. Revenues declined 14.3% YoY, missing estimates. Ad-revenues declined 17% YoY, impacted by muted FMCG spending, further exacerbated by viewership (hence ad-spend) shift towards sports and geopolitical content. Subscription revenues were broadly flat (-0.6% YoY), as pay-TV churn persisted. Other sales and services declined sharply (-64% YoY), with no material syndication/theatrical income in the quarter. There were a few bright spots though. Zee5’s revenues grew 30% YoY, aided by good response to Zee5’s language pack and digital syndication. That helped lower Zee5’s losses to INR 0.66bn (-12% QoQ). ZEEL’s viewership share improved to 17.8% in June, highest in past two years. This, along with a strong content slate for 2H, possible conclusion of DPO negotiation and possibly better spend environment led management to reiterate their FY26 targets – 8% ad revenue growth and 18-20% EBITDA margin. Though encouraging, we see risk to these numbers. We expect a gradual recovery to both ad-revenues and margins. We build -1%/16 revenue growth/EBITDA margin for FY26E. No equity dilution however limits impact on earnings. With no promoter stake raise now, value unlocking through music remains a key trigger. BUY.

* 1QFY26 – Miss on all fronts:

ZEEL reported revenues of INR 18.3bn (-14.3% YoY), missing JMFe: INR 19.0bn. Ad-revenues declined 17% YoY to INR 7.6bn ( JMFe: INR 7.9bn), impacted by muted FMCG ad spends and viewership diversion towards sports and geopolitical events. Subscription revenues declined 0.6% YoY to INR 9.8bn, broadly inline. Other sales and services revenues declined 64% YoY to INR 0.9bn (JMFe :INR 1.16bn). Zee5 revenues increased 30% YoY, aided by digital syndication. Zee5 EBITDA losses narrowed to INR 658mn (-12% QoQ). Consol. EBITDA margin came in at 12.5%, missing JMFe: 13.5%. Operating deleverage and ad-spend for Zee’s new brand identity weighed. PAT came in at INR 1,436mn, missing JMFe: INR 1,650mn.

* Cautiously optimistic: ZEEL reiterated its target of c.8% YoY growth in ad revenues. It however expects a back-ended recovery in ad-spend. Management’s cautious optimism is underpinned by a low base, healthy monsoons, and the festive season. Besides, its improved viewership share should help it get its fair share of wallet share once spend returns. ZEEL’s viewership share improved to 16.8% (40bps YoY) in 1Q. Its viewership share in June reached 17.8% and has touched 18% in July, per the management. Zeel is also hopeful of a recovery in subscription revenue, aided by upcoming MSO negotiations. On Zee5, progress toward breakeven continues, led by subscriber growth and cost rationalization. Management reaffirmed FY26 EBITDA margin target of 18-20%.

* EPS revised (-3%) -3%; Retain BUY: We have lowered our revenue and margin estimates given the miss in 1Q. We now build 16% EBITDA margin for ZEEL in FY26, and expect them to only exit FY26 at their desired EBITDA margin target of 18-20%. The impact of these on EPS is however negated by no dilution due to warrant issues, which we had built in. Consequently, our TP goes up to INR 200 from INR 190 earlier. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)