Buy Star Cement Limited For the target Rs. 235 By the Axis Securites

Recommendation Rationale

Capacity Expansion to Drive Growth: The Guwahati 2 mtpa Grinding Unit (Line 2) is ramping up well, with capacity utilisation reaching 77% during the quarter, and is expected to further improve in the ensuing quarter, thereby contributing to the company’s volume growth. The Silchar Grinding Unit is expected to be commissioned by Q3FY26. These expansions will increase the company’s total capacity to 9.7 mtpa from the existing 7.7 mtpa, providing substantial growth potential. The company is projected to grow its volume at a CAGR of 10% over FY23-26E

Plant Incentives & Cost Optimization to Support Higher EBITDA/Tonne: The company’s Grinding Units in Guwahati and Silchar, along with its Clinker Unit in Meghalaya, are set to receive SGST refunds as part of Assam government incentives, estimated at Rs 150-170 Cr annually. These units benefit from a reduced tax rate of 17%. Additionally, increased sales of premium cement, advantages from the WHRS plant in terms of lower power costs, and other efficiency gains are expected to enhance EBITDA per tonne

Cement Demand in Northeast and Eastern India: Cement demand in these regions is expected to remain stable due to (a) government initiatives to boost infrastructure and housing development and (b) lower per capita cement consumption than the national average.

Sector Outlook: Positive

Company Outlook & Guidance: The company has guided for 10% volume growth in Q4FY25 and 12-15% in FY26. Prices have improved in the Northeast and are expected to trend higher depending on demand.

Current Valuation: 12.5x FY26E EV/EBITDA (Earlier Valuation: 12x FY26E EV/EBITDA)

Current TP: Rs 235/share (Earlier TP: Rs 235/share)

Recommendation: We maintain our BUY rating on the stocks.Alternative BUY Ideas from our Sector Coverage: UltraTech Cement (TP – 13,510/Share), Dalmia Bharat (TP – 2,000/Share), JK Cements (TP – 5,380/share), Ambuja Cement (TP -655/share), Shree Cement (TP - Rs 30,000/share), Birla Corporation (TP – 1,390/share)

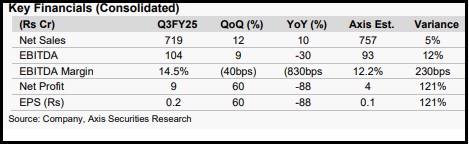

Financial Performance SCL reported mixed results for the quarter. Volume was in line with expectations, while revenue was below expectations, and EBITDA/PAT were above expectations. Revenue grew by 10% YoY; however, EBITDA and PAT declined by 30% and 88%, primarily due to negative operating leverage, higher depreciation, and lower other income. The company achieved an EBITDA margin of 14.5%, which was better than expected but down from 22.8% in the previous year. Volume for the quarter stood at 1.07 mntpa, reflecting 9% YoY growth, driven by new capacity ramp-up. EBITDA per tonne stood at Rs 977, down 36% YoY and flattish QoQ but above the expectation of Rs 869/tonne. Blended realisation per tonne was Rs 6,736, up 3% YoY and 0.5% QoQ. Cost per tonne increased by 11% YoY to Rs 5,759, driven by higher other expenses.

Outlook With its upcoming capacity expansion, the company is well-positioned to capitalise on the rising demand in its operating region, primarily the Northeast. We project the company will achieve a CAGR of 10%/13% in volume and revenue and a 17% CAGR in EBITDA over FY24-FY26E.

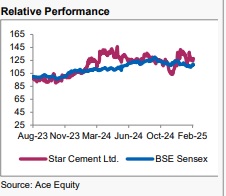

Valuation & Recommendation The stock is currently trading at 11.5xFY26E EV/EBITDA. We maintain our BUY recommendation on the stock with a TP of Rs 235/share, implying an upside potential of 10% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633