Buy KPIT Technologies Ltd For Target Rs.608 by Prabhudas Liladhar Capital Ltd

Inline Q2, Deal ramp-ups and easing macro to drive H2 performance

Quick Pointers:

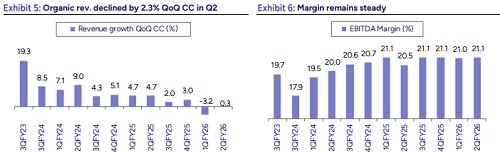

* Organic business declined 2.3% QoQ CC while consolidated grew by 0.3%

* Deal wins of USD 232 mn in Q2 vs USD 241 mn in Q1

The operating performance (+0.3% QoQ CC) was fairly in line with our estimates that include USD 2.5% QoQ inorganic growth from 2-month consolidation of Caresoft. The organic USD revenue de-growth translates to 2.3% QoQ, which is primarily driven by softness in PV segment, middleware services and weakness in US/Japan regions. Part of these impacts are attributed to spending that the clients have deprioritized, and discontinued programs which are non-strategic in nature, while the other part is being cannibalized with AI-led products and solutions. The efforts are in place to compensate the slowdown in part of the operations with additional scope of offering and exploring adjacencies that require similar discipline and skillset. The quarter witnessed a large strategic deal (three-year) with a Europe automotive OEM that will partly support Q3 growth before it achieves its full potential in Q4. Additionally, the revenue derived through JV (Qorix) is sporadic in nature and reported one-time loss (INR 60m) in Q2. We are adjusting FY26E/FY27E/FY28E revenue growth and margin on account of continued slowdown in PV, especially in the US region that is hinting a staggard recovery instead of sharp uptick. EPS adjustment is primarily attributed to higher depreciation and slower turnaround of JV than anticipated. We are assigning 33x PE to Sep. 27E earnings, translating a TP of 1,380. Maintain “BUY”.

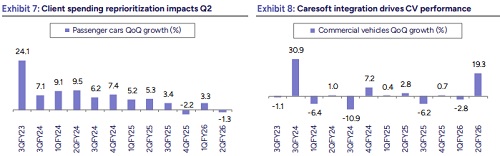

Revenue: KPIT reported revenue of USD 180.9 mn, up 0.3% QoQ CC and 1.7% QoQ USD, in line with our 0.3% QoQ CC estimate. Organic revenue declined 2.3% QoQ CC (-0.8% USD), with two months of Caresoft integration offsetting the drop. Commercial Vehicles grew 19.3% QoQ while Passenger Cars fell 1.3% QoQ. Function wise - Feature Development & Integration and Cloud services grew 3.9% and 10% QoQ, respectively, while Architecture & Middleware declined 12.9% QoQ.

Operating Margin: KPIT reported a flattish EBITDA margin in Q2, while EBIT margin declined due to higher amortization from the Caresoft acquisition. EBITDA margin was steady QoQ at 21.1%. EBIT margin came in at 16.4%, down 60 bps QoQ, below our and consensus estimates of 16.9% and 16.7%, respectively.

Deal Wins: KPIT reported TCV of USD 232 mn in Q2, versus USD 241 mn in Q1FY26 and USD 207 mn in Q2FY25. Deal wins include a USD 100 mn+ multi-domain engagement with a European client, which has begun contributing to revenue and is expected to ramp up from Q3 onward.

Valuations and outlook: We estimate USD revenue/earnings CAGR of 11.4%/17.5% over FY25-FY28E. The stock is currently trading at 37x FY27E, we are assigning P/E of 33x to Sep. 27E EPS with a target price of INR 1,380 & maintain our “BUY” rating.

KPITTECH Q2FY26 Firstcut - Inline performance, Deal TCV soft again.

* Revenue came at USD 180.9 mn, up 0.3% QoQ CC & up 1.7% QoQ in USD, inline of our estimates of 0.3% QoQ CC growth. Caresoft revenue consolidated for 2 months while contributing 2.5% QoQ growth

* Commercial vehicles grew by 19.3% QoQ due to Caresoft integration while Passenger cars declined by 1.3% QoQ. Feature development & integration and cloud-based services grew by 3.9% & 10% QoQ respectively while architecture & middleware declined by 12.9% QoQ

* Geography-wise Europe grew by 12.9% QoQ while US & Asia declined by 4.4% & 10.2% QoQ respectively

* Revenue from Strategic clients grew by 1% QoQ

* EBITDA margin was flat QoQ at 21.1% while EBIT margin came at 16.4%, down 60 bps QoQ, was below our & consensus estimate of 16.9% & 16.7% respectively due to higher depreciation & amortization

* Net Headcount grew by 334 QoQ to 12.9k

* Deal wins came at USD 232 mn compared to USD 241 mn in Q1FY26 & USD 207 mn in Q2FY25

* Reported PAT came at Rs 1.69 bn (down 1.6% QoQ & 17% YoY) compared to our estimates of Rs 2.03 bn

Conference Call Highlights

* Demand environment is improving as tariff and geopolitical uncertainty eases, with OEMs gradually resuming structured program discussions. Client spending remains selective, with cuts in legacy programs but strong traction in validation, autonomous, diagnostics, cybersecurity, and solution-led engagements. FY27 is expected to see a steady, not sharp, recovery supported by deal ramps and stabilizing architecture/middleware cycles.

* Strong traction is visible in digital cockpit, validation, after-sales diagnostics, cybersecurity, and autonomous programs, supported by KPIT’s shift to holistic, AI-led solutioning. Europe remains the strongest demand engine, Asia (India/China) is accelerating, and the US is expected to recover in 1–2 quarters driven by off-highway and commercial vehicle programs.

* Management indicated that LTM revenue was impacted by ~USD 65mn, comprising USD 45mn from client-led reprioritization in legacy autonomous and middleware programs across the US, Asia, and parts of Europe. The remaining USD 20mn reflects cannibalization from KPIT’s shift toward holistic, AI-led solutions that replaced traditional work. Management expects this to recover over time as these solution-led engagements will aid to expand wallet share with client.

* Management expects H2 to improve meaningfully, supported by clearer demand visibility and the ramp-up of recently won programs. Q3 should deliver flattish to marginally positive organic CC growth, while Q4 is expected to show a stronger uptick as large deals scale and client spending stabilizes.

* EBITDA Margins are expected to remain ~21%, supported by a rising mix of solution-led engagements, AI-driven productivity gains, and disciplined talent restructuring. Despite wage hikes and full-quarter Caresoft consolidation, management remains confident that profitability can be sustained through improved realization and operational efficiency.

* Qorix saw a weak quarter due to delayed license revenues and one-time accounting charges. Management mentioned that OEM deferrals in middleware and architecture pushed out near-term scaling, though its strategic importance has increased. Management expects revenue normalization from next quarter and better medium-term traction as new architecture programs resume

* Net headcount rose by ~300, driven by 800 additions from Caresoft which was offset by ~500 role rationalizations linked to solutioning and AI competency needs. Management mentioned that hiring will continue, especially for niche and onsite roles, while workforce reshaping remains an ongoing process to align with the shift toward higher-value solution-led delivery.

* KPIT is investing in adjacent areas such as off-highway, commercial vehicles, industrial/manufacturing, micro-mobility, and selective defense opportunities, leveraging existing technology and client relationships. These areas align with KPIT’s strengths in software-defined mobility and provide medium-term growth opportunity.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271