Accumulate Apollo Hospitals Enterprise Rs 8,670 by Elara Capitals

Growth steps up

Apollo Hospitals Enterprise (APHS IN) reported strong Q3FY26 with revenue, EBITDA and PAT surpassing our estimates by 3%, 8% and 19%, respectively. All the three business verticals – hospitals business, pharmacy (HealthCo) and ancillary healthcare (AHLL) – performed better than our estimates. Revenue and EBITDA from the Hospitals business grew 14% and 18% YoY, respectively, a sharp improvement over high-single-digit levels of H1FY26. While other factors contributed, negotiated price revision by insurance companies was a major driver in our assessment. EBITDA for HealthCo (up 126% YoY) and AHLL (up 39% YoY) too came in better than our estimates. We raise our FY26E-28E EBITDA estimates (pre-IndAS) by 3-8%. Accordingly, we raise our core EPS estimates by 6-15% for FY26E-28E. We retain Accumulate and raise our target price to INR 8,670 from INR 8,395.

Hospitals – Growth accelerates: Revenue from Hospitals grew 14% YoY. Margin picked up as well and EBITDA grew 18% YoY. The rise in the proportion of advanced procedures (minimal access surgeries, daycare procedures and robotic surgeries) continued with reduction in ALOS and increase in ARPOB, thereby sustaining topline growth. In addition, Q3 benefitted from tariff increase of 3%, translating into realization increase of 5%. We expect this benefit to stay for three more quarters, leading to stronger growth. Beyond that, we expect ~9-11% sustainable EBITDA growth for FY27E from existing beds to continue.

APHS targets to maintain margins despite new bed additions: APHS is entering a period of large greenfield capacity addition, starting from early FY27. It is adding ~2,700 beds in the next 24-36 months on the current base of ~8,800. The management targets to maintain stable overall EBITDA margin, with improvement in margin of existing beds compensating for the loss / lower margin from the new beds. However, we remain conservative and build in some margin impact from new beds. Despite that, we see EBITDA of hospital services growing at low double-digit CAGR over the next three years.

HealthCo – Progressing as planned: Revenue of the pharmacy business was up 20% YoY and EBITDA margin (excluding Apollo 24/7 expenses) expanded to 7.6%. We continue to expect steady margin improvement in this business. This along with lower expenses for Apollo 24/7 should help improve overall margin of HealthCo. The impending closure of the deal with Advent PE and Keimed will be key monitorable in this business.

AHLL – Active expansion in diagnostics: AHLL posted 20% topline growth and 39% EBITDA growth in Q3. EBITDA growth was helped by a low base. Diagnostics is leading growth for this vertical.

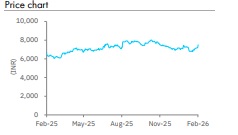

Retain Accumulate; TP raised to INR 8,670: We raise our FY26E-28E EBITDA estimates (pre-IndAS) by 3-8%; accordingly, we raise our core EPS estimates by 6-15%. APHS trades at 54x FY27E core P/E and 29.5x FY27E EV/EBITDA. We raise our TP to INR 8,670 from INR 8,395, which is 29.4x FY28E pre-IndAS EV/EBITDA. Retain Accumulate. Increased competition in hospitals and slower ramp-up in the pharmacy business (HealthCo) are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933.