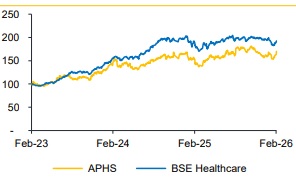

Buy Apollo Hospitals Ltd for the Target Rs. 9,000 by Choice Institutional Equity

Multi-engine growth across healthcare platform: Hospital segment revenue is expected to grow through capacity expansion, with plans to add ~45% beds in next 5 years (current 10,325 bed capacity) and sustained EBITDA margin of around 24%. The diagnostics arm (AHLL) is expected to drive sustained highteen revenue growth and mid-teen EBITDA margin beyond FY27, driven by expansion in primary care and diagnostic services. Apollo HealthCo (pharmacy) is set to achieve ~20% CAGR by FY28E, expanding its footprint, from 6 major cities to 25 cities, underpinned by stronger penetration in high-potential emerging cities and deeper integration across the healthcare ecosystem. View and valuation: We forecast revenue/EBITDA/PAT to expand at a CAGR of 18.3%/19.5%/24.0% over FY26–28E. Valuing the stock on an average of FY27- 28E SoTP valuation, we maintain our target price of INR 9,000 and BUY rating on the stock (maintained). We value Hospitals at 22x EV/EBITDA (from 20x), AHLL at 10x EV/EBITDA and HealthCo at 3x EV/EBITDA (refer Exhibit 2).

Results beat our estimate & saw strong YoY growth on all fronts

? Revenue came in at INR 64.8 Bn (vs. CIE est. at INR 63.2 Bn), up 17.2% YoY and 2.8% QoQ, driven by increase in volume and better case mix

? EBITDA came in at INR 9.7Bn (vs. CIE est. at INR 8.9Bn), up 26.8% YoY and 2.6% QoQ. EBITDA margin came in at 14.9% (vs. CIE est. of 14%)

? PAT came at in INR 5.0Bn (vs. CIE est. of INR 4.8Bn), significantly up 38.8% YoY and 8.3% QoQ, with a PAT margin of 8.0%

Hospital segment: 1,500-bed capacity expansion driving multi-year growth visibility: APHS is entering a significant expansion cycle with ~1,500 additional beds being added across Hyderabad, Kolkata, Bangalore and Gurgaon. Of these, 40–50% will be operationalised by Q1FY27, with the balance coming online by early FY28. New hospitals operating initially at ~40% occupancy and ramping up, thereafter, creates strong revenue optionality. 9MFY26 ARPP growth stood at ~10%, supported by higher complexity procedures including cardiac, oncology, neuro, gastro, ortho and transplant, which grew 15% YoY, and transplant revenue rose ~50% QoQ at group level. Base hospitals are already operating at ~67% occupancy, with metro facilities at ~70%, providing operating leverage headroom. We expect that new beds could add 3–4% incremental revenue growth, over and above the 13–14% growth expected from the existing network, implying a potential revenue growth trajectory.

Apollo HealthCo & AHLL: Consumer-led growth engines with strong scale potential: Apollo HealthCo and AHLL are strategic growth levers accelerating Apollo’s consumer-facing ecosystem. HealthCo is projected to reach INR 25,000 Cr revenue run-rate by Q4FY27, up ~25% from the existing INR 20,000 Cr annualised level, driven by ~20.5% pharmacy revenue growth, ~16% samestore growth, ~600 net new stores annually and rising private label share (~15.5%). AHLL’s expansion in clinics and diagnostics continues, enhancing cross-referrals and cluster economics. We believe that, together, these businesses are expected to contribute meaningful, diversified revenue growth with improving margin, supporting mid-teens growth in the medium term.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131