Add Apollo Hospitals Enterprise Ltd For Target Rs. 8,854 By InCred Equities

Higher growth & expansion plan raise hopes

* Financial performance in 3QFY26 was above our expectations on all fronts due to double-digit growth across its three verticals.

* Expansion plan (till FY30F) strengthens the footprint of Apollo Hospitals Enterprise across India to 13,000+.

* We maintain our ADD rating on the stock with a higher target price of Rs8,854. Downside risk is any delay in expansion plan.

3QFY26 performance above our expectations on all fronts The 3QFY26 performance of Apollo Hospitals Enterprise (AHEL) was above our expectations on all fronts. Revenue growth of 17% YoY was due to double-digit growth across all its three verticals. Revenue growth was 5% due to volume, 4% due to case mix, and 5% due to pricing. Gross margin at 47.8% increased by 28bp on YoY basis and dipped by 50bp on QoQ basis. EBITDA margin at 14.9% was flattish QoQ and improved by 110bp YoY, with PAT margin at 7.8%, up 90bp on YoY basis.

Business updates and company’s guidance 1) Revenue from CONGO-T specialties grew by 16%, while volume in CONGO-T grew by 6%. Average revenue per in-patient (ARPP) grew by 11% to Rs180,917 in 3QFY26. 2) Bed occupancy rate for the quarter was 67%,100bp lower on YoY basis. Apollo Hospitals Enterprise had 9,561 operational beds as of 3QFY26-end. 3) Pune (75 beds) and Defence Colony, Delhi (30 beds) were operationalised in 3QFY26. 1,660 census beds are expected to be commissioned in FY26F-27F and 1,970 beds in FY29F-30F, taking the consensus bed count to 13,100. Of the beds next year, 40– 50% are expected to be operational in FY27F (new bed occupancy is ~40% in the first year). 4) Company’s board has declared an interim dividend of Rs10 per share (face value of Rs5). Gurugram hospital launch delayed to 2QFY27 due to some issue related to environmental clearance. The newly commissioned hospitals in Pune and Athenaa, Delhi reported Rs150m loss in 3QFY26. 5) Expected EBITDA drag from new hospitals is Rs1.4-1.5bn for 2HFY26F. 6) Management expects the existing hospitals to grow at 13–14% and new beds to add 3 – 4% growth.

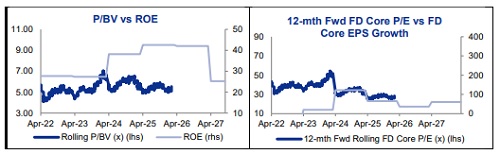

Maintain ADD rating with a higher target price of Rs8,854 We rolled our target price on Apollo Hospital Enterprise forward, keeping the estimates in line to arrive at a higher target price of Rs8,854 (Rs8,549 earlier) with a one-year horizon. Downside risks: Delay/additional costs in expansion plan.

Segmental business updates in Q3FY26

Healthcare services: Revenue at Rs31.8 bn was up 14% YoY, while EBITDA at Rs7.9bn was up 18% YoY. PAT increased at the rate of 21% on YoY basis.

AHLL (Apollo Health and Lifestyle): Revenue at Rs4.7bn was up 20% YoY, while EBITDA at Rs476m was up 39% YoY. Net loss for the quarter stood at Rs62m.

Apollo Healthco: Revenue at Rs28.2bn was up 20% YoY, while EBITDA was at Rs1.28bn. PAT was at Rs866m for the quarter

Regional business updates in Q3FY26

* Revenue in the Tamil Nadu cluster grew by 14.3%. ARPP grew by 9% to Rs2,02,804.

* In Andhra Pradesh/Telangana, revenue grew by 16.4% and ARPP grew by 6% to Rs1,91,546.

* In Karnataka, revenue grew by 15.8% and ARPP grew by 18.1% to Rs1,91,388.

* In eastern region, revenue grew by 15% and ARPP grew by 9.5% to Rs1,54,408.

* In Western region, revenue grew by 17% and ARPP grew by 12% to Rs1,66,264.

* In Northern region, revenue grew by 11.7% and ARPP grew by 15.6% to Rs1,75,836.

Other highlights

* Apollo Healthco opened 185 new stores in 3Q and now has 7,113 offline stores. It plans to add 600 offline stores every year. Management is confident of achieving 32% growth in GMV on an adjusted basis. The merger of Apollo Healthco and Keimed has secured approval from Securities and Exchange Board of India and management awaits NCLT clearance.

* AHLL (Apollo Health and Lifestyle) launched two new clinics, one each in Chennai and Hyderabad, in 3QFY26. Most centre additions during the quarter were for its diagnostic business.

Above views are of the author and not of the website kindly read disclaimer