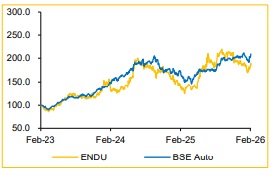

Add Endurance Tech Ltd for the Target Rs. 2,820 by Choice Institutional Equity

Broad-based growth across segments: ENDU delivered a strong operational performance in Q3FY26, supported by resilient demand across India and Europe. Consolidated total income grew 26.5% YoY, reflecting healthy volume momentum and consolidation benefits. EBITDA increased 28.1% YoY, with margin expanding to 13.2% due to operating leverage and favourable product mix. However, on a standalone basis, margin was impacted by commodity headwinds. RPAT rose 20.2% YoY despite commodity pass-through timing and one-off labour-related cost. We believe the company’s focus on premium products, localisation and electronics integration strengthens its competitive positioning. Strong execution in EV components and advanced braking systems improves visibility for sustained medium-term growth.

EV transition leads to resilient growth in Europe: European operations recorded strong revenue growth of 39.5% YoY in INR terms during Q3FY26. Performance was supported by the Stöferle acquisition, which added meaningful scale and profitability. Underlying demand remained stable, despite macro uncertainty and softer tooling income. A rising mix of electric and hybrid vehicles continues to structurally support Endurance’s Europe portfolio. The management remains focused on margin protection through localisation, operational efficiency and disciplined capital allocation

We expect the company’s focused investment in capacity expansion, R&D and technology partnerships to position it well to capture upcoming regulatory tailwinds (ABS/Brakes) and EV market opportunities.

View and Valuation: We largely maintain our FY26/27/28E EPS estimate and value the company on a P/E multiple of 27x on FY28E EPS. We maintain our target price of INR 2,820 and upgrade our rating from 'REDUCE' to 'ADD', considering EV-led growth, premium product mix and high visibility from a robust order book.

Q3FY26 results beat our estimate across the board

? Revenue was up 26.2% YoY and up 0.7% QoQ to INR 36,082 Mn (vs CIE est. at INR 35,134 Mn)

? EBITDA was up 28.1% YoY and up 0.1% QoQ to INR 4,771 Mn (vs CIE est. at INR 4,638 Mn). EBITDA margin was up 19 bps YoY and down 9 bps QoQ to 13.2% (same as CIE est)

? APAT was up 31.6% YoY and up 6.7% QoQ to INR 2,426 Mn (vs CIE est. at INR 2,286 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131