Economics Sector Report : RBI Room for another 25bps cut still open

Today, the RBI’s Monetary Policy Committee (MPC) lowered the policy repo rate by 25bps to 5.25% in a unanimous decision, while maintaining a Neutral stance, in line with our expectations. The tone of the policy was dovish with Governor Malhotra reiterating benign inflationary environment (referenced six times in the statement). Inflation projection was reduced by 60bps to 2.0% for FY26E (Elara: 1.9%) and growth projections were revised higher by 50bps to 7.3% (Elara: 7.5%) for FY26E versus the previous meet, reflecting robust H1FY26 growth print. The continued benign inflation outlook, and prospects of moderating real GDP print by Q1FY27 (as deflator expands and given fading boost from GST cuts) suggest that room for another 25bps cut still exists in Feb-2026 policy

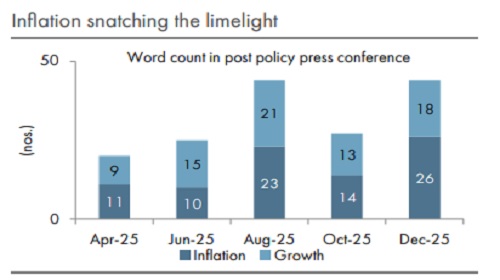

Room for another rate cut still open: Today’s policy tone was skewed towards dovishness, led by continued comfort on inflation. Based on the press conference transcription and the MPC member statements, analysis per our natural language processing (NLP) models indicates that the focus on inflation increased in Dec-25 meet with inflation’s share at ~60% versus 40% in Jun-25 meet (share in combined “inflation” and “growth” word count) with highest co-occurrences with the words “low”, “benign”, and “decline/drop”. We are of the view that the 'wait and watch' hesitation seen in October 2025 driven by tariff headwinds has effectively cleared, as the collapse in inflation provided space for policy easing.

Our forecast path for inflation aligns with the RBI viz., 3.8-4% in H1CY26E. Our checks across mandis in India suggest continued softness in food prices despite crop damages. Our analysis shows inflation persistence – the number of sub-segments where inflation is greater than the series mean is at 15% (3mma basis), the lowest since CY19, indicating only handful of items contributing to overall inflation. Also, nearly 78% of the components are below 4% YoY inflation versus 63% same time last year.

Growth projection upgraded: The RBI MPC revised FY26 GDP growth upward by 50bps to 7.3% (FY26E Elara estimate: +7.5%), primarily reflecting stronger-than-expected expansion of 8.0% in H1FY26. However, the RBI MPC expects moderation in H2FY26, primarily led by weaknesses in export-oriented sectors and normalization of the base effect. The RBI remained positive on growth drivers, led by uptick in private consumption demand aided by GST rationalization, healthy agricultural activity bolstering rural demand, and policy support continuing to cushion domestic activity. In its press conference, the RBI underscored that 7% growth remains its baseline aspiration.

Inflation projection downgraded: MPC acknowledged that the recent improvement in food supply conditions supported by higher Kharif output, healthy rabi sowing and comfortable reservoir levels should help anchor headline inflation, going forward. The RBI MPC lowered inflation for FY26 to an average of 2.0% from 2.6% (Elara estimate: +1.9%) with Q3 at 0.6%; Q4 at 2.9% and H1FY27 at 3.9-4%. Furthermore, the RBI acknowledged that the underlying inflation remains subdued, with precious-metal price effects accounting for roughly 50bps

Liquidity infusion to strengthen policy transmission: The RBI’s announcement of INR 1tn open market operations and USD 5bn three-year USD/INR buy-sell swaps was broadly in line with our expectations, as potential challenges to durable system liquidity have incrementally intensified. As of mid-Nov-25, net durable liquidity stood at 1.4% of net domestic and time liabilities (NDTL), which may fall further below 1% in Q4FY26 due to seasonal factors. In the short term, USDINR buy sell operations are likely to inject durable rupee liquidity and rebuild FX reserves synthetically, allowing the RBI to tolerate a weaker rupee while preventing disorderly overshoots. On the external front, the INR remains undervalued on a real effective exchange rate basis and continues to face persistent depreciation pressures amid global risk aversion.

Above views are of the author and not of the website kindly read disclaimer