Buy Hindalco Industries Ltd For Target Rs. 800 By JM Financial Services

Novelis past its trough; strong performance in India business to continue

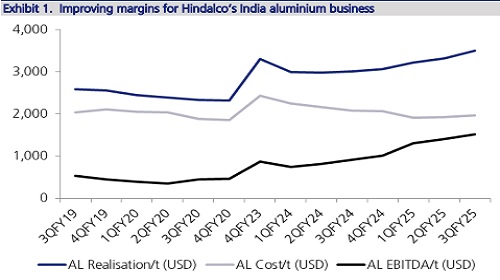

With Aluminium prices remaining strong above ~USD2.6k/tn levels and the company guiding for Novelis’ 4QFY25 performance to be in line with that of 2QFY25 (implied EBITDA/tn: ~USD490/t), makes Hindalco our preferred play in the aluminium space with good earnings visibility for the next six months. India business margins are expected to trend upwards primarily driven by a) deficit forecast in aluminium leading to prices sustaining above ~USD2.6k/tn levels b) subdued coal prices and c) value-accretive upstream expansion projects (180ktpa Al smelter, 0.85mtpa Al refinery). This has led to improved margins of Hindalco’s India aluminium business with EBITDA/tn sustaining above USD 1k/tn (~USD 1.5k/tn in 3QFY25) for the past 4 quarters, significantly above historical levels of ~USD 0.7k/t. We also believe Novelis margins have troughed given a) high scrap prices leading to bottoming out of spreads – unlikely to worsen further as it would discourage recycling capacity and restrict demand b) recent imposition of tariffs has led to significant growth in Midwest premiums with spot premium at ¢38/lb, up 78% from Dec’24 levels, potentially leading to recovery in scrap spreads and c) volume growth driven by Bay Minette (600ktpa) and debottlenecking projects (~200ktpa). We expect Net debt/EBITDA to remain range-bound at ~1.2x over FY25-27. The outlook for Hindalco continues to be buoyant given resilient performance by India aluminium operations and enhanced coal security post acquisition of Meenakshi, Meenakshi West and Chakla coal mines. We re-iterate BUY.

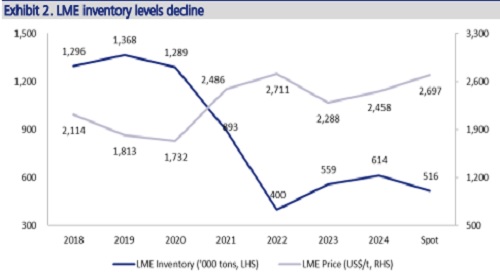

* Higher realisation / expansion projects to drive India business earnings: The India business of Hindalco remains strong on all fronts with improving domestic demand, higher realisation and expansion-oriented capex, and a focus on increasing domestic capacity in aluminium and alumina. Aluminium prices have remained strong at USD2.6k/tn+ levels, significantly above 10-year average of ~USD2.1k/tn primarily on account of a) major global players like Alcoa / Norsk Hydro hinting at global aluminium deficit (~550k tonnes) in CY25 after 3 years of surplus, and b) lower inventory levels (519k tonnes vs. recent peak of 639k tonnes in Dec’24). This has boosted margins for Hindalco’s India aluminium business with EBITDA/tn at ~USD 1.5k/tn in 3QFY25, up ~USD 0.6k/tn YoY. This trend is expected to continue with subdued coal prices alongside elevated metal prices. Focus on value-accretive upstream projects like 180ktpa Al smelter, 0.85mtpa alumina refinery and ~0.3mtpa copper smelter to further drive earnings.

* Midwest premium expand given US tariffs; scrap spreads may have bottomed out: We believe Novelis margins have troughed given a) high scrap prices have already led to bottoming out of spreads – unlikely to worsen further as it would discourage recycling capacity and restrict demand b) recent imposition of tariffs has led to significant growth in Midwest premiums with spot premium at ¢38/lb, up 78% from Dec’24 levels, potentially leading to recovery in scrap spreads and c) volume growth driven by Bay Minette (600ktpa) and debottlenecking projects (~200ktpa). Hindalco also guided for Novelis’ EBITDA/tn to be in the vicinity of USD 500/tn in 4QFY25 driven by higher recycling rate / better sales mix and new contract pricing effective from 1st Jan’25.

* Bay Minette to drive volume growth; demand robust: The new rolling mill and recycling capacity under construction at Bay Minette remains on track for completion by Dec’26. This will take Novelis’ capacity to ~5mtpa post commissioning and the company expects double-digit IRR on the project. Bay Minette (600ktpa) along with debottlenecking (~200ktpa) projects should drive Novelis’ volume growth which has remained stagnant over the last 3 years. The demand outlook for CY25 remains robust with Novelis’ major customers guiding for strong demand for beverage cans in Europe and South America

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361